The first half of 2022 was the worst first half for stocks since 1970 and the worst six months for bonds since 1980.[1] The S&P 500 Index returned -20.0% while the iShares US Core Aggregate Bond ETF returned ‑10.2 percent. The 10-year US Treasury finished June yielding 3.02%, double the 1.51% at which it began the year. Reversing much of the stock market’s strong performance in 2021 (+28.7%), stock price levels returned roughly back to where they were in March 2021. Stocks are trading at cheaper valuations now. Markets have been rocked not only by runaway inflation, but also by the Fed’s prescription to rein it in.

The Consumer Price Index (CPI) continued its march higher, up 9.1% year-over-year in June, and up 5.9% excluding food and energy, their highest rates in 40 years. The Federal Reserve is seeking to rein in inflation by tightening monetary policy, which will slow economic growth probably to the extent that it causes a recession, as our colleague Bob Sanders discussed in our last Quarterly Market Perspectives (see QMP Spring 2022). Even as the Fed tightens and economic growth slows, we expect inflation to stay relatively high through the end of the year. Unfortunately, this is not a good backdrop for equity appreciation. Investors will need to gain confidence that inflation is subsiding and that the Fed will end its tightening program. Also, importantly, the expected recession is likely to bring down earnings estimates. It’s hard to see stocks making meaningful headway until investors see that earnings revisions are stabilizing.

Inflationary Pressures Will Diminish

The rate of inflation depends significantly on the strength of the economy. With US gross domestic product (GDP) growing 5.7% last year, its fastest real growth rate in 37 years, inflation perked up. While we did not expect inflation to rise as much as it has, we now expect it to decline gradually from its current high level. The Federal stimulus programs enacted in 2020 and 2021 to counteract the pandemic have mostly been exhausted, suggesting consumer spending will moderate. Many companies laid off employees and scaled back capacity during Covid-19, leaving them ill prepared for the snapback in demand. Given time, they will hire back and expand capacity as needed.

Multiple waves of Covid-19 outbreaks have extended manufacturing supply chain snarls, but these bottlenecks are gradually easing. The war in Ukraine has been a further shock to the global economy, driving shortages of key commodities, particularly oil, steel, and wheat. Inflation has become an issue beyond our borders as well—it’s running at 8.6% in the Eurozone, driven by a 42% increase in energy prices.[2] The European Union was grappling with an energy crisis even before Russia invaded Ukraine.

The Fed Is Willing to Risk a Recession

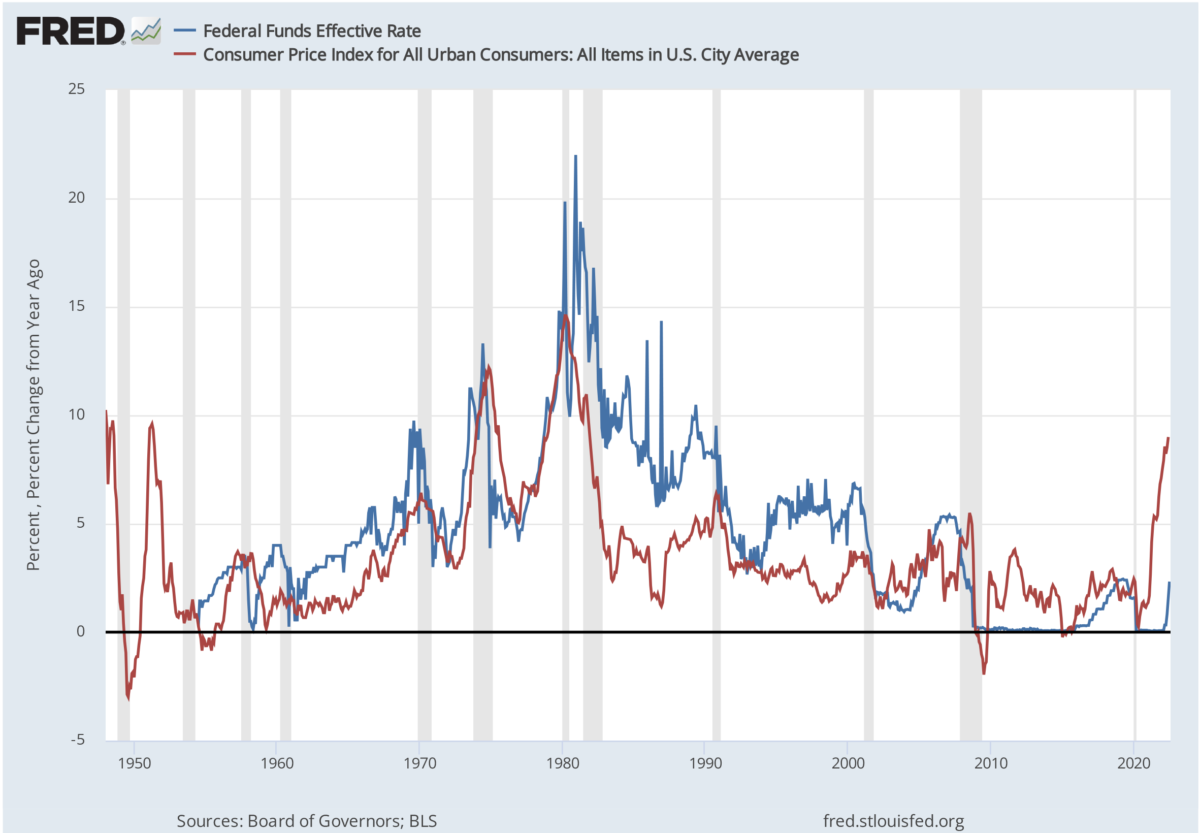

Because the Fed was reluctant to raise interest rates when inflation was rising through 2021, it now finds itself behind the curve. Inflation has gotten out of control, and the Fed is rightfully committed to bringing it down. The Fed has been tightening policy aggressively, raising the fed funds rate at the fastest pace since the 1980s, from a range of 0.0%-0.25% as recently as March up to 2.25%-2.50% at present. In addition to hiking rates, the Fed started quantitative tightening in June, shrinking its balance sheet by $47.5 billion worth of bonds per month, on its way to $95 billion per month starting in September.

Fed officials are prioritizing controlling inflation over economic growth—they are willing to risk a recession in order to get inflation back under control. That Fed officials are so focused on bringing inflation down makes it likely that they will tighten monetary policy too much. When asked at a June press conference about the risk of tightening too much, Fed Chairman Jerome Powell responded, “Is there a risk we go too far? Certainly there’s a risk. The bigger mistake to make … would be to fail to restore price stability.”[3]

Previously, Powell had elaborated, “What we need to see is clear and convincing evidence that inflation pressures are abating and inflation is coming down. …If we do see that, then we can consider moving to a slower pace [of rate hikes].”[4]

The Fed’s official line is that it can achieve a “soft landing”—reducing inflation without causing a recession. We and many others are skeptical this can be accomplished. According to CNBC reporter Nathan Lee, “Every recession but one since World War II has seen an inflation hike right before the downturn. And nearly every recession since World War II has seen the unemployment rate fall to 5% or lower [before the recession].”[5]

Unemployment is hovering just above a 68-year low, at 3.6%.

History Lessons

There have been at least nine times in recent history where raising rates led to recessions. In his attempt to justify the strategy, Chairman Powell cited three instances when the Fed embarked on rate-hiking cycles which did not cause recessions: 1965, 1984, and 1994. But in none of these cycles did the CPI exceed 5%, making the possibility of pulling off a soft landing under the current conditions all the less likely. In the first two instances cited, the federal funds rates started and remained well above the CPI. There was a brief period in 1993 when the CPI exceeded the federal funds rate, but throughout 1994 the federal funds rose to exceed the CPI by 2.8 percentage points. That compares to a gap of 6.7 percentage points, inflation exceeding the funds rate, at present (see Figure 1).

Historically, short-term bond yields exceeding long-term bond yields has been a fairly good indicator that a recession is coming, with the condition having occurred before each of the last six recessions.[6] Short-term bond yields are currently higher than long-term bond yields.

While interest rate hikes have an immediate effect on financial markets, they will continue to slow both the economy and inflation for one to two years after they are announced. For instance, the average 30-year fixed mortgage rate went from 3.1% at the beginning of the year to 5.7% by mid-year, impacting home affordability. It will easily take a year or two for the diminished purchasing power of home buyers using mortgages to play out in both home selling prices and sales volumes. Higher rates will further dampen demand for renovation and new building construction as existing projects are finished. The results are only observable after the economic statistics have been compiled. As Fed officials look for confirmation that inflation is conclusively trending lower, the effects of their ongoing tightening efforts will continue to work through the economy. The cumulative effects will continue to play out well after they stop tightening, and will almost certainly be enough to push the economy into a recession.

What could make the coming recession unusual is its predictability. Most recessions are not foreseen. To the extent that individuals and businesses expect a recession, they can prepare for it by reining in spending and fortifying their balance sheets today. Thus, we may be better prepared for the coming recession, making it less harmful.

Figure 1. Fed Funds Rate and Consumer Price Index

Economic Statistics Start to Turn Down

The US and the global economies are already slowing. Concerns of a recession are rising in Europe as well. High prices are eroding purchasing power and crimping consumer spending, as are interest rate hikes. Higher interest rates and slowing economic growth have both been pressuring stock prices, and will eventually dampen inflation.

US Real Personal Consumption Expenditures (PCE) growth, adjusted for inflation, turned negative in May. Nominal PCE is rising at a brisk pace, but that is only because consumers are paying more for the same quantity of goods and services. Real Personal Income has been declining for five months.[7]

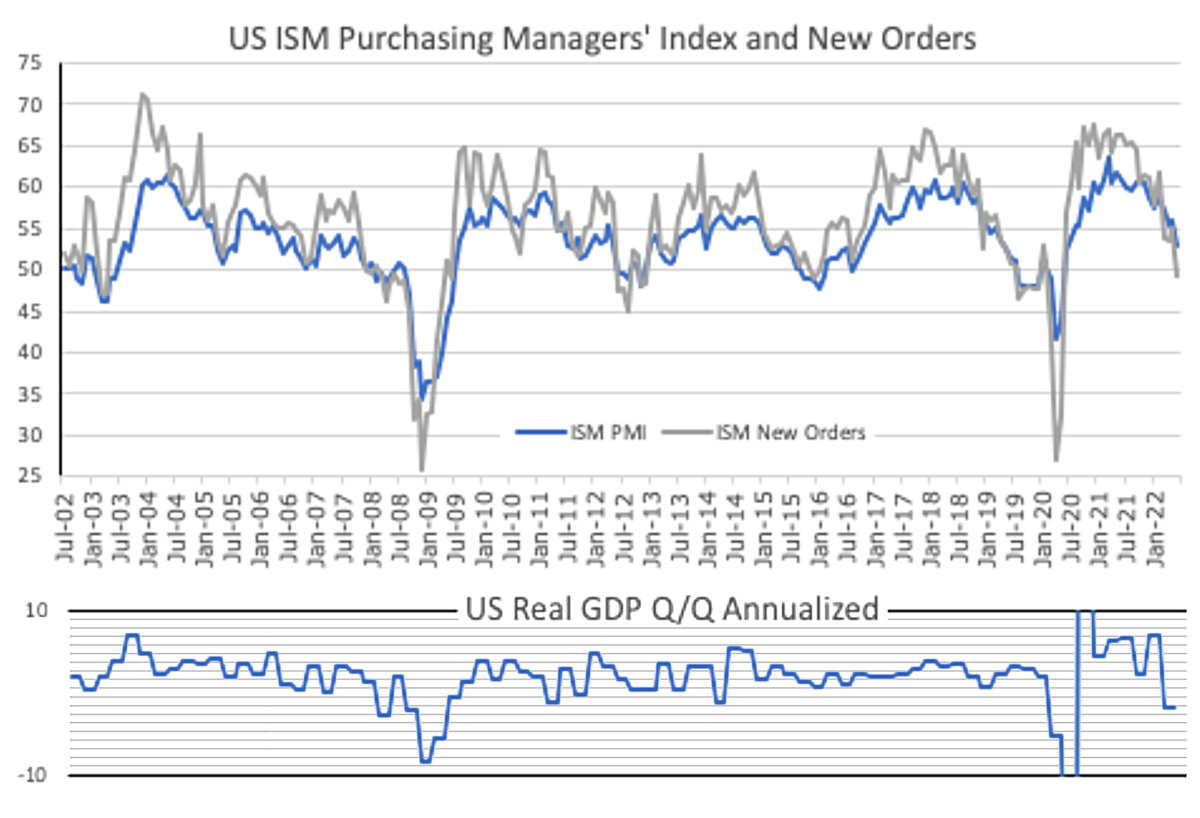

The Institute of Supply Management’s (ISM’s) Purchasing Managers’ Index fell to 53.0 in June, its lowest rate in two years, from 56.1 in May. Any number above 50 indicates expansion, so manufacturing activity in the US is still growing, but from the ISM chart it’s evident that growth has rolled over (see Figure 2). The new orders component of the PMI hit 49.2 in June, entering contraction territory, and manufacturing employment also contracted. Orders probably aren’t slowing so much because of rising rates but because businesses may have over-ordered in response to supply-chain challenges, and because higher prices themselves may be crimping demand.

Over the year to June 30, the US dollar appreciated 13.1% against the euro, 22.2% against the Japanese yen, and has continued to appreciate against both since then. The strong US dollar is a further drag on the economy, encouraging imports and discouraging exports. Export orders from Asia are declining even though a strong US Dollar should stimulate them.

Figure 2 – Purchasing Managers’ Index on the Edge of Contraction

Source: Bloomberg, St. Louis Federal Reserve FRED

Inflation May Stay Stubbornly High

On a combined basis, home ownership and rent account for 32% of the CPI and 41% of the CPI excluding food and energy. The S&P/Case-Shiller National Home Price Index was up 20.4% over the year through April, and was up 41.7% since before the pandemic. Home prices are also an important driver of rent. Mortgage and rental agreements set prices for a fixed period of time such that changes in housing costs work their way into consumer spending gradually. The CPI formula is designed to reflect this dynamic. Because the shelter component of CPI, which was up 5.6% in June, is below the headline CPI number, it has actually served to keep the headline number lower than it otherwise would be. But shelter is likely to contribute to the broader index at an elevated rate for at least the next two to three years as current prices are worked into the calculation.

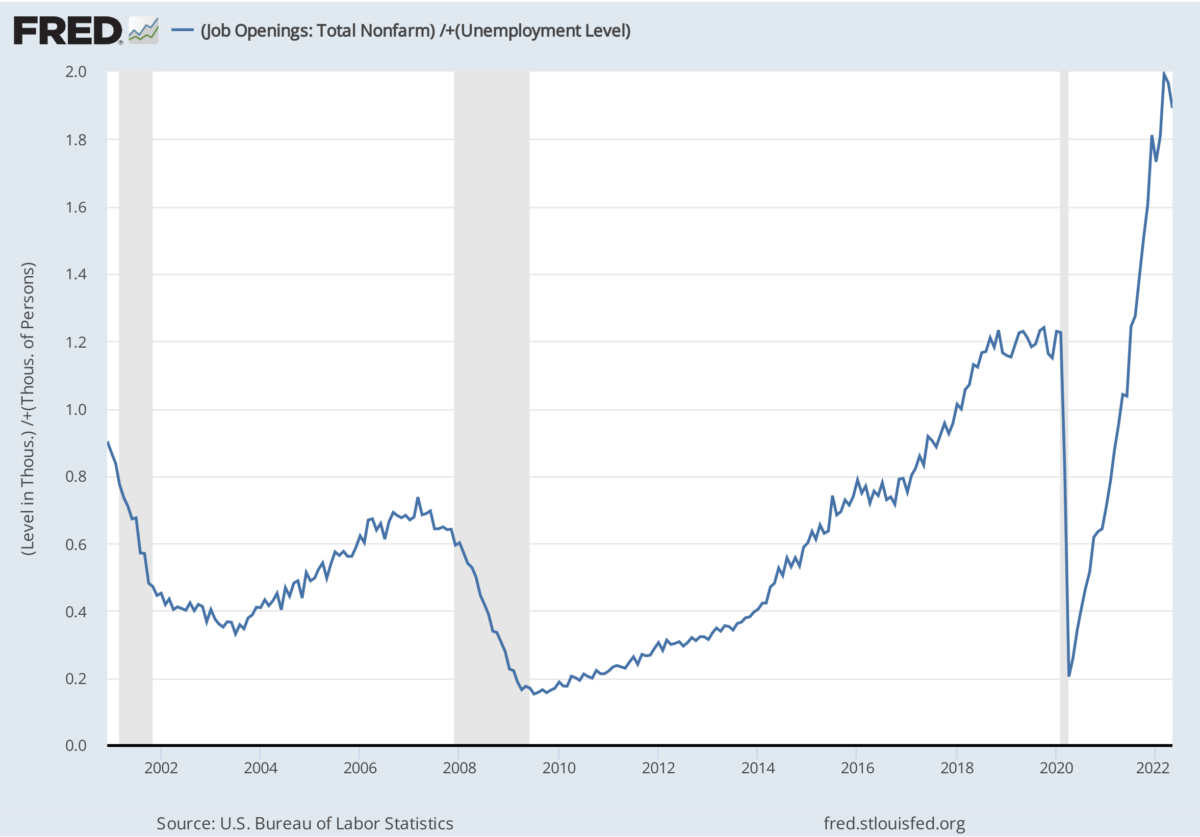

Workers’ average hourly earnings are currently rising at a 5.2% clip, supported by strong demand. This strong demand for workers is reflected in the ratio of job openings to job seekers nationwide, which has skyrocketed to 1.9 at present. While workers deserve wages that keep up with the cost of living, many economists believe that if wage growth expectations were to become entrenched, they would contribute to more enduring inflation. The upward pressure on wages is unlikely to let up until the job-openings-to-seekers ratio falls back more in line with the cyclical range depicted in Figure 3. To the extent that the labor shortage has been caused by baby boomers retiring and others permanently leaving the workforce, the labor shortage could even persist through an economic downturn.

Figure 3 – US Job Openings

Commodity prices have generally come down since May, reflecting traders’ concerns of an impending recession, but the war in Ukraine has brought new challenges, specifically heating Europe this winter and coming up with enough agricultural products to feed countries dependent on imports. Commodity prices continue to pose a threat to price stability. With continuing pressures from housing, wages, and possibly commodities, the CPI could linger in the 7%-9% range for several months. We do not believe this range is low enough to dissuade the Fed from continuing its tightening campaign.

A recession would likely have a fairly powerful dampening effect on inflation—the Fed has felt comfortable enough with diminishing inflationary risks to cut interest rates the last twelve times we’ve been in recessions. However, with inflation unusually high, getting it back under control is likely to be a multiyear process. Even in a recession, inflation can stay relatively high. It is unrealistic to expect inflation to get back to the Fed’s target rate of 2% by 2023 without a wrenching downturn. How bad the forecast recession gets depends on how zealous the Fed remains. The Fed might stop raising rates as inflation eases, but officials will be reluctant to cut rates until inflation is sustainably lower than the federal funds rate.

Expect the Unexpected

The average peak-to-trough stock market decline during the past eleven recessions has been 26 percent.[8] The market was down 21.1% from its January 3 market peak to mid-year, excluding dividends, a stone’s throw from fully discounting an average recession. By this reasoning, we may have reached a market bottom.

However, further consequences of inflation and the tightening cycle may continue to play out. Easy money has accumulated, not just since the Covid-19 pandemic, but at least since the Great Financial Crisis, allowing inefficient businesses to operate and inflated asset prices to persist. To quote Warren Buffett, “You don’t find out who’s been swimming naked until the tide goes out.” The monetary tide is going out. During tightening cycles, idiosyncratic problems often come to light: many companies dependent on outside funding are likely to go bankrupt. We may still be realizing business closures, revaluing assets, and witnessing transaction liquidity drying up for the next several years. Higher interest rates could create problems on a larger scale, presenting challenges to whole industries, markets, and even currencies. We believe high-quality companies should be well protected from these surprises, and may even capitalize on the opportunities they present.

At the same time, macroeconomic news could certainly break to the upside from here. Supply chain problems will eventually be alleviated. China could stop locking down whole cities in their efforts to eradicate Covid-19. Scientists could find a more decisive solution for Covid-19. The war in Ukraine could come to some resolution. Any or all of these developments should be welcome news to investors.

The most positive development for the stock market would be for inflation to subside. The Fed can’t rescue the economy until inflation comes under control. Stocks are most sensitive to the uncertainty. It’s hard to see them advancing without having greater clarity on the path for inflation and interest rates. When the Fed stops tightening, we may have a better sense of how deep the expected recession will be.

Downturns are an inevitable part of stock investing. Whether the stock market goes up or down over the next several months misses the point. No one knows what path inflation will take, or what will spark the market’s turnaround. Well-diversified portfolios tend go up over time, so investors are well served by staying fully invested. We put our faith in high-quality companies to manage through the market turbulence. In addition to making sure your portfolios weather difficult conditions, we are looking to take advantage of attractive valuations afforded by market weakness to position client portfolios for the next bull market.