The stock market roared ahead in the first half of 2023, returning +16.9% and defying predictions for another difficult year. The stock market sailed through the demise of four medium-sized banks,[1] a Congressional debt ceiling showdown, higher interest rates, and widespread calls for a recession.

Market pundits have been referring to the possibility of inflation subsiding without a major impact on economic growth or employment as the “soft landing” scenario. As of this writing, inflation and economic reports are indicating that the economy appears to be landing softly. The headline Consumer Price Index (CPI) of 3.0% for June surprised many of us because it had moderated so much while job growth has remained strong and gross domestic product (GDP) growth has held up. The US economy grew an estimated 2.4% on an annualized basis in the second quarter and added an average of 270,000 nonfarm jobs to the payrolls per month through the first half of the year.

Several of us at Woodstock, along with many other market observers, have been calling for a recession for more than a year now.[2] The US has not entered a recession, at least not yet. Our recession thesis was based on the US economy confronting simultaneous fiscal and monetary policy contraction. Contracting federal spending should curb GDP growth and many of us believed it would bring consumer spending down with it. Consumers are being further pressured by the rising costs of living. In this precarious state, the Fed’s aggressive tightening campaign seemed likely to tilt the economy into recession.

The Conference Board’s Index of Leading Economic Indicators has been contracting for 15 months in a row. We’ve had a manufacturing recession, but not a broader economic recession. Europe, which is experiencing comparable if not higher inflation, has been in a recession. US corporate earnings have also suffered, declining year-on-year for the past three quarters. And yet the broader US economy has proven to be resilient. It is possible that we are experiencing a rolling recession, with different sectors of the economy contracting at different times. This would spread out the economic dislocation, making it more manageable. Whatever is happening in various sectors, however, the largest component of GDP, consumer spending, has remained solid. Without showing up in the broad economic statistics yet, there may be pressures building under the surface. The cumulative effect of the interest rate increases and monetary tightening will continue to play out, slowing the economy.

What Have Calls for Recession Missed?

Those of us forecasting a recession underestimated both the backlog of demand created by supply chain constraints and consumers’ resilience. Consumers bolstered their balance sheets during the pandemic by receiving federal subsidies and by spending less. Economists have attempted to measure consumers’ “excess savings,” which is a rather spurious concept: a much bigger problem is that Americans haven’t saved enough for retirement. Nevertheless, consumers seem to have been spending the incremental savings they accumulated during the pandemic. Consumers’ excess savings, and “revenge spending”—consequences-be-damned spending because one is tired of exercising pandemic-era restraint—have helped to keep aggregate spending numbers strong. The economy could be less sensitive to interest rates than we thought, but there is Nobel laureate Milton Friedman’s caveat that “monetary actions affect economic conditions only after a lag that is both long and variable.” Meanwhile, the stock market has done well because inflation is falling even as consumer spending and employment have held up.

Fiscal Challenges

The federal deficit ballooned during Covid-19, hitting 14.9% of GDP in 2020 and 11.9% in 2021 before shrinking to 5.4% in 2022. We are fortunate that substantial cutbacks in government spending have not caused the economy to contract, at least not yet. According to the Congressional Budget Office, the deficit is due to expand to 5.8% of GDP this year, with the composition of the deficit changing somewhat. Stimulus spending related to pandemic relief has been replaced by higher interest expenses and higher social spending programs. Some readers will recall that an 8.7% cost of living adjustment was rolled out to Social Security beneficiaries in January of this year (estimated to increase 3.1% in 2024). The US Treasury issues most of the federal government’s debt at shorter maturities, making our government the biggest loser from higher rates. According to at least one forecast, federal debt service (interest payments) alone could surpass the defense budget by 2028.[3]

The Inflation Reduction Act, the CHIPS and Science Act and the Infrastructure Investment and Jobs Act are helping to stimulate business spending. Government and business spending have contributed to the strength in Personal Consumption Expenditures (PCE) and will likely continue to. At 5.8% of GDP, the federal deficit needs to come down further. Going forward, higher recurring deficits are likely to keep real interest rates higher. To the extent that the Fed allows short-term rates to come down, with or without an economic contraction, America’s fiscal position stands to benefit.

Personal Consumption Expenditures

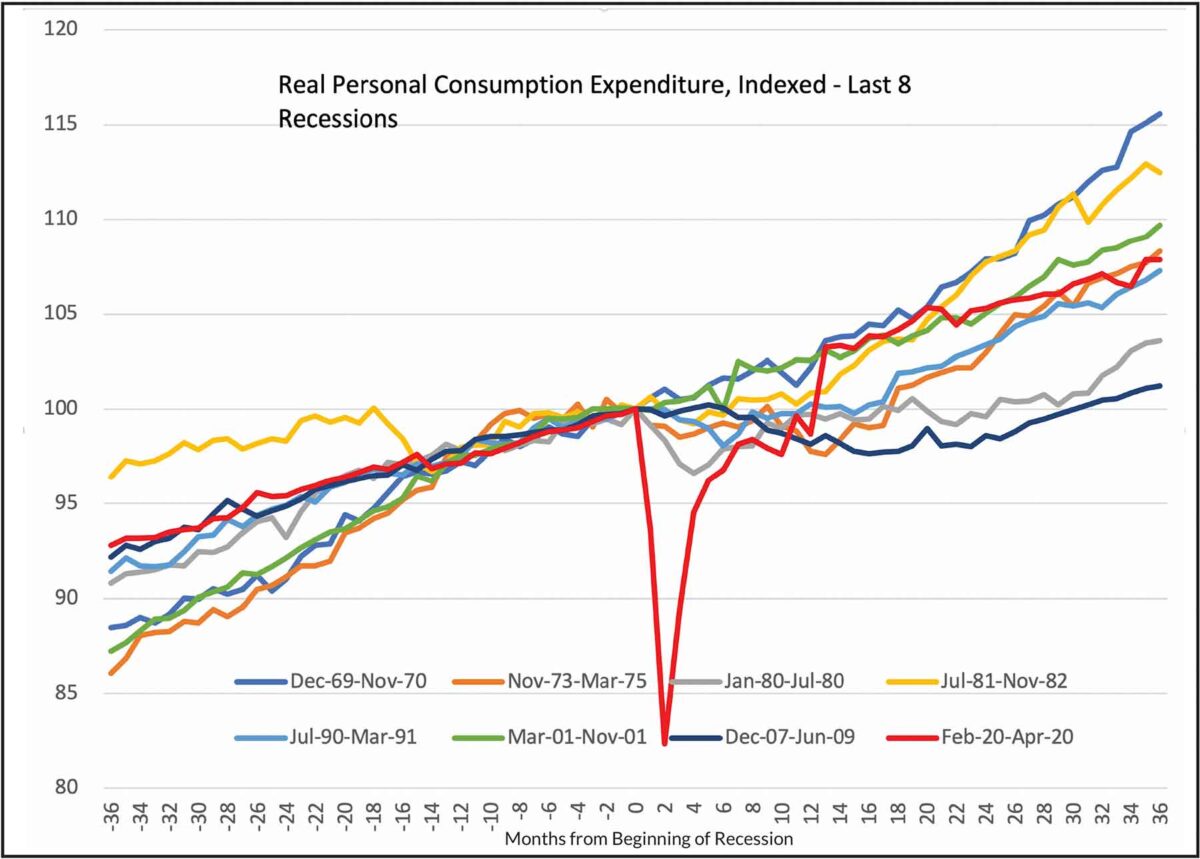

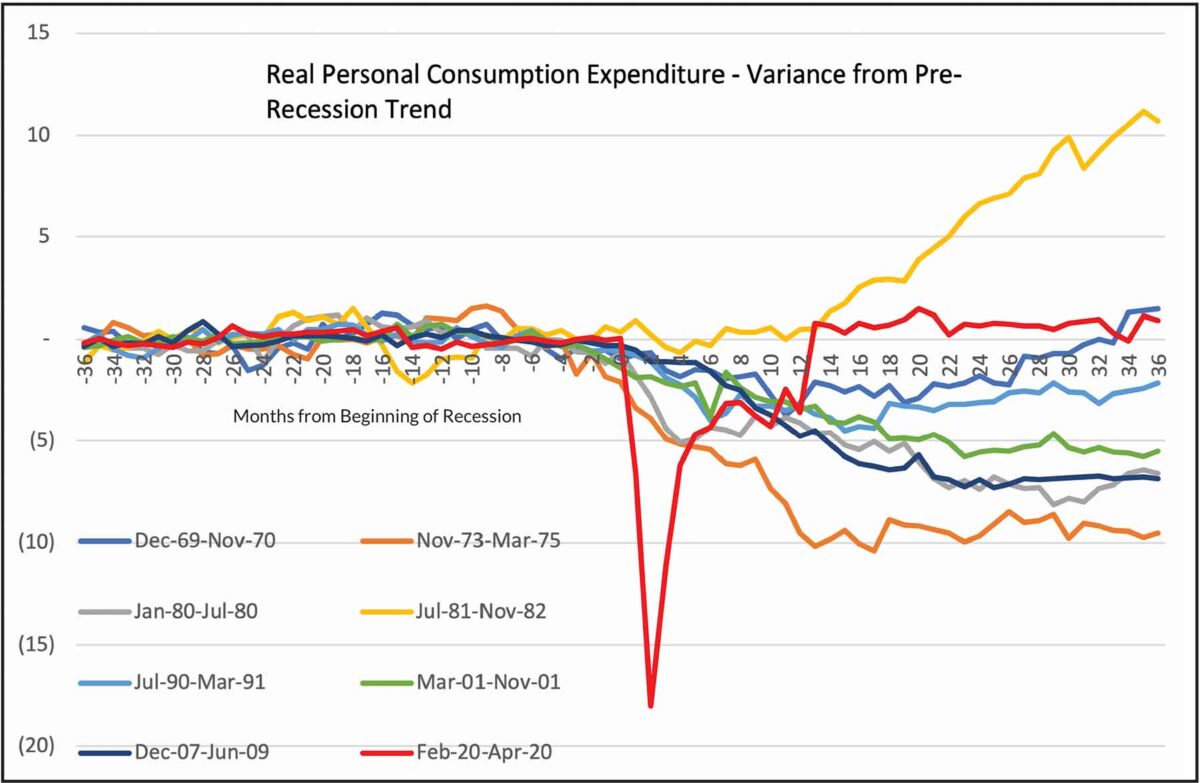

PCE, accounting for about two-thirds of GDP, held up much better during and after thepandemic recession than it had in five of the prior seven recessions. The accompanying charts (Figures 1 & 2) show real (inflation-adjusted) PCE for the last eight recessions. The data presented are the real PCE beginning three years prior to the recession start and three years after the start, indexed to 100 on the first month of the recession (month 0).

After a recession, PCE tends not to recover to its pre-recession growth trajectory. In Figure 1, real PCE seems to have held up best for the December 1969-November 1970 recession. Note that the economy was growing rapidly before this recession. Even though real PCE recovered sharply after the recession, it did not match its prior growth rate until 32 months after the start of the recession. This is more evident in Figure 2, which uses the same data to compare real PCE variance against its linear trendline for start of each recession. In each case, real PCE stays fairly consistent with the trendline established from this data. Figure 2 shows the divergence from trendline during and after each recession.

Figure 1. Personal Consumption Expenditures Don’t Typically Recover Fully After a Recession

Source: St. Louis Federal Reserve, Woodstock Corporation

The next line which stands out in Figure 1 is the July 1981-November 1982 recession. PCE recovered in short order, arguably seven months after the start of the recession, but note that this was the second part of a double-dip recession. The pre-recessionary period overlaps with the indexed data from the January-July 1980 recession. With this prior recession in its prelude, real PCE was particularly anemic going into the 1981-1982 recession, as manifest in a flatter line to the left side of Figure 1. Real PCE recovered at an accelerated rate after the recession, but mainly because economic growth had been suppressed going into it.

The December 1969-November 1970 recession and the July 1981-November 1982 recession notwithstanding, the 2020 pandemic recession stands out as having the strongest recovery (Figure 2). The pandemic recession was the shortest recession of the eight, but 22 million people still lost their jobs. Despite the sudden dislocation, real PCE rebounded back above its prior recession trendline thirteen months after the start of the recession and has mostly stayed there.

Figure 2. Real PCE Variances from Pre-Recession Trend

Source: St. Louis Federal Reserve, Woodstock Corporation

Government stimulus helped consumer spending recover. The stimulus has subsided, but consumer spending has persisted at a high level. With regard to helping PCE recover to its pre-recessionary trendline, it appears that fiscal and monetary authorities have done a good job of managing the economy. Our economic resilience could be an example of Keynesian deficit spending successfully bridging the economic output gap, but there’s room for skepticism. If consumers are spending down “excess savings,” then the current rate of spending probably is not sustainable. A recession isn’t inevitable, but still seems probable.

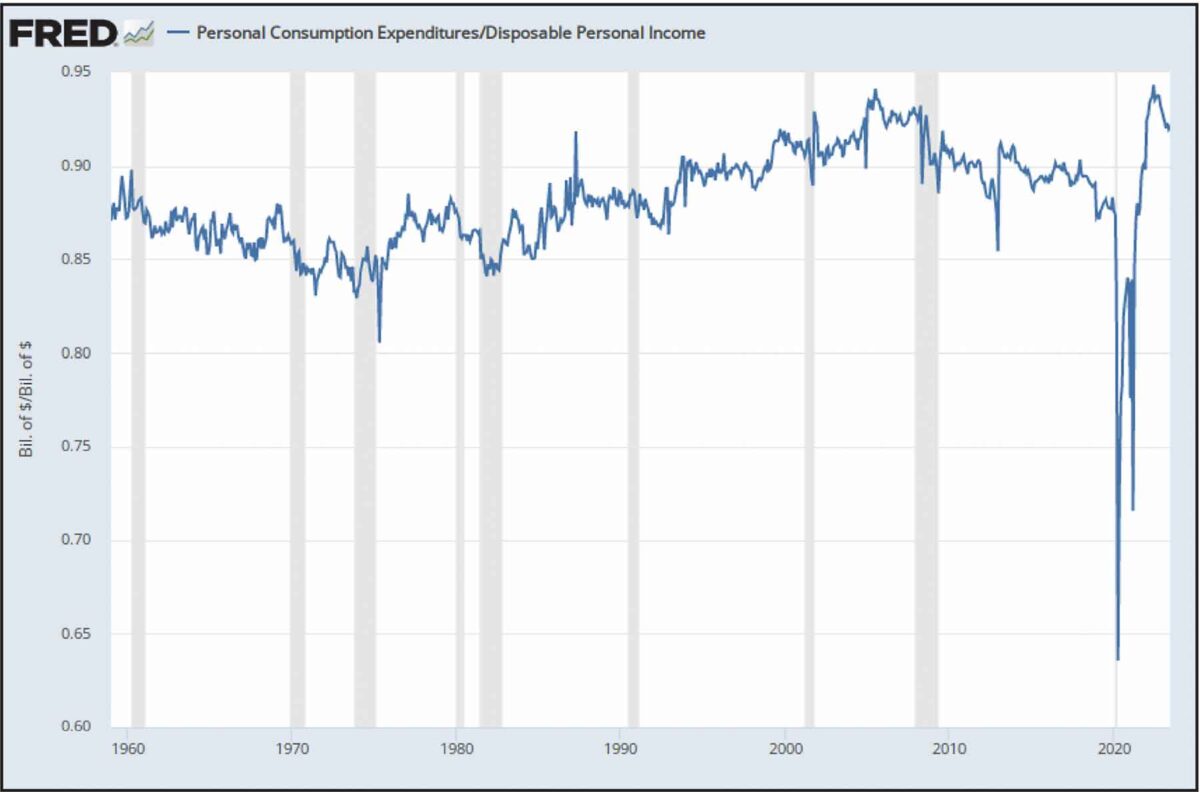

Figure 3. Consumer Spending as a Percent of Income

Source: St. Louis Federal Reserve

Figure 3 shows PCE as a percentage of Disposable Personal Income (DPI). The pandemic and related shutdowns caused a unique cessation of spending. The ratio rebounded to a sixty-year high (94.3%) as consumers spent their excess savings. PCE has declined from its peak, but at 92.2% in June, remains at the high end of its historic range. Consumers are still spending in rare form.

Will the Fed Pivot to Lower Rates?

Inflation appears to have been caused by the pandemic, our policy responses to it, the ensuing supply chain challenges, and the war in Ukraine. Factors related to the pandemic are now normalizing. Inflation statistics, in their multifarious permutations, have mostly been on downward trends and seem likely to continue to moderate, at least for the next few months. Perhaps the headline CPI rate of 3.0% and the PCE Price Index, also 3.0% for June, are low enough, or are trending down close enough to the Fed’s 2% target, for the Fed to stop raising rates. Core CPI (excluding food and energy prices) remains uncomfortably high at 4.8%, as does the core PCE Price Index, up 4.1 percent. The statistics excluding food and energy price changes followed their corresponding broader indexes up last year, and so far are following them down this year.

Fed officials will need to have confidence that inflation will stay low before they cut rates. They are still worried about the tight labor market having a more lasting effect on inflation. Even with supply chain pressures easing, average hourly earnings are still up 4.4% year-over-year. Higher wages are of course good for workers, but with labor being a significant part of most every company’s cost structure, they can be a critical driver of cost-push inflation. Tight labor market conditions are caused at least in part by baby boomers and others permanently retiring from the workforce.

With various frictions in the system including the tight labor market, getting inflation down from 3% to 2%, “the last mile,” may prove as challenging as getting inflation down to 3 percent. Can the Fed tolerate 3% inflation, if only temporarily, or is it worth incurring a recession in order to get inflation back to their 2% target quickly? Fed officials have said and acted as if they are willing to incur a recession in order to get inflation down to target. Allowing observers to perceive that they are willing to tolerate anything higher than their target could itself be counterproductive, and yet Fed Chairman Jerome Powell said he didn’t see inflation getting back to the Fed’s target rate until 2025.[4] He is being patient. Believing it will take until 2025 to bring inflation back to 2%, it is hard to imagine the Fed cutting rates much before then. Conditions are of course subject to change. If inflation falls faster than expected, the Fed could adjust policy accordingly.

As long as the economy is growing satisfactorily, any additional stimulus afforded by cutting rates would risk fueling inflation. The Fed doesn’t want to be in the business of inflating asset prices—the stock market— either. They will cut interest rates if the economy deteriorates enough, but they are reluctant to squander their ammunition unless there is an evident need. The closer inflation gets to 2%, the stronger the argument becomes for cutting rates. The stock market may continue to respond favorably to lower inflation, anticipating a pivot in Fed policy.

Even as some inflation metrics may continue to fall in the near term, there are longer-term pressures driving inflation higher. Some of the more prominent secular pressures include: baby boomers retiring, companies restructuring their supply chains as geopolitical tensions rise, more extreme climate events causing economic dislocations, and rebuilding our infrastructure to accommodate alternative energy. With greater investment needs, interest rates could enter territory that looks more like the 1980s and 1990s than the 2010s. That is, higher on a secular basis.

Do We Still See a Recession?

Several of us at Woodstock still see a recession as the most likely outcome. Borrowing is more expensive. We have yet to feel the full economic impact of the now 5.25 percentage points of rate hikes which are working their way through the system. The four banks that collapsed this spring may have been most exposed to the challenges brought about by higher rates, but all banks are facing similar financial pressures to a greater or lesser degree. Higher interest rates are causing funding issues for banks, which in turn are constricting credit. The credit contraction has started to show up in the prices of commercial real estate transactions, and should be evident to anyone trying to get a commercial loan. Highly leveraged companies are affected as well. Loan delinquency and default rates have started to rise, although they are still at low levels.

Inflation may very well fall further. Those of us expecting a recession doubt the Fed’s ability to wield its tools, which operate with a one-to two-year lag, deftly so as to manage a soft landing without also denting economic growth. If the economy stays strong, inflationary pressures would likely stay with us, in which case the Fed would continue to keep monetary conditions tight, or even tighten them, until signs of economic weakness become evident. On the other hand, the broader economic outlook has improved greatly since the start of the year. Economic growth has persisted despite inflation falling. The possibility of a soft landing appears more realistic. Manufacturing, having been down for so many months, seems due to turn up, and the bank crisis has at least so far been contained.

Opportunities in Cash, Bonds, and Stocks

The recovery from the pandemic recession has been unusually strong. That is encouraging, although it begs the questions of what has led to the strength and how sustainable it is. Our aggressive policy response may have been instrumental in navigating the pandemic recession well, but the verdict is still out. Consumer spending seems extended and may very well retrench, a scenario which could easily be triggered by the Fed’s tightening. The backdrop of high federal deficit spending seems to allow less room for error. The deficit isn’t sustainable at this level of GDP, and needs to be reduced even if cutting it would be a headwind to economic growth.

For now, the Fed is trying to achieve tighter monetary conditions. The bull case for stocks seems to involve the Fed having a change of heart, pivoting to looser monetary policy. The portfolio managers at Woodstock heartily debate whether inflation will revert to the Fed’s target of 2% without a recession, and a number of us do not see the Fed loosening policy in the absence of a recession. While stocks typically benefit from looser monetary policy, earnings and stock prices go down when there’s a recession. We can hope against precedent that this time is different, or that last year’s stock market decline fully anticipated a recession which has yet to come. The good news is that if the US enters a recession, the Fed would likely ease policy, with easier policy likely pushing stocks higher, making a recession a great opportunity to add to stock portfolios.

Cash and bonds are yielding about 4%–5%, levels not seen since the mid-2000s. Being relatively safe assets and generating healthy yields, cash and bonds deserve consideration as components in most portfolios. They also raise the bar for what returns investors should expect from risky assets. One can expect higher returns when starting from lower valuations. The stock market is currently expensive, with the S&P 500 Index trading around 19.7 times forward earnings, and those earnings are based on ambitious growth expectations. However, there is a lot of optimism that is focused on a small number of very large capitalization stocks. Most members of the S&P trade at much more modest multiples than the exalted seven largest capitalization US stocks,[5] which make up more than 25% of the index. We believe there are always opportunities to find companies that have great potential. The market factors contemplated in this article are subject to many variables which are difficult to forecast, and could play out in myriad ways with very different implications for your portfolio. It usually isn’t worth taking the capital gains to make major allocation shifts, nor are investors likely to be successful trying to time the market. Stocks generally go up over the long term, and we encourage clients to stay focused on the long term. Whatever happens, your portfolios are broadly diversified, populated with high- quality stocks, preparing you for an array of possible market conditions.

Adrian G. Davies, President