Woodstock Quarterly Newsletter / Winter 2018

Woodstock sits both in the larger financial industry of banks, insurance companies, broker dealers and investment management firms, and amongst our competitors in the investment management world. In the larger financial industry, who gets to keep the difference between a historic 8% return on equities, an “equity-like return”, and a historic 4% return on “risk free” investments, such as government bonds? Currently government bonds are at 2% while stocks have kept up their 8% average return, so the question is even more important now. Also, as interest rates rise above 2%, a bond originally bought yielding 2% will lose market value.[1]

Various simple and complex investment products from banks, insurance companies and broker dealers try to take advantage of the public’s fear of “risk” by “guaranteeing” a 4%, or currently 2%, return in exchange for the investor not caring who reaps the benefit of the difference between 8% and 4%, or even 2%.

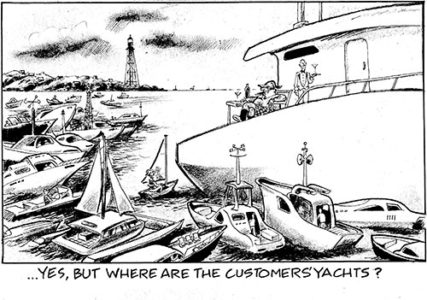

Once in the dear, dead days beyond recall, an out-of-town visitor was being shown the wonders of the New York financial district. When the party arrived at the Battery, one of his guides indicated some handsome ships riding at anchor.

He said, “Look, those are the bankers’ and brokers’ yachts.”

“Where are the customers’ yachts?” asked the naïve visitor.1

_________________________________________________________

1 Where are the Customers’ Yachts? Fred Schwed, Jr. New York, 1940 & 2006.

This historic New Yorker cartoon, the “Customers’ Yachts” seeks to capture this squalid, but still humorous situation.

We don’t have to go back to 1929 to illustrate our point. Since 1999 the US financial world has had two 30%+ drops in the stock market (the “risk”) and for those who did not panic and sell, a subsequent market recovery has generated an 8% annualized return on equities even including the two spectacular drops. While we have to say, and we actually believe, that past performance is no guarantee of future returns, we believe that Woodstock represents our clients’ best opportunity to capture that equity-like return into their own accounts rather than negotiate it away in purchasing an investment product, because we believe we have done it.

Amongst our competitors in investment management, what differentiates Woodstock? We like to review SEC Form 13Fs. This form is filed by investment managers over a certain size and lists recent investment holdings. While we and others can tout our skill and investment processes, the 13F reveals what we, and they, hold for our clients. Look for up and coming names in the industries that will drive US growth: information technology and healthcare biotech. And look for the names connoting stability and irreplaceability in energy and consumer staples, all the time keeping “quality” in mind. We believe our 13F shows those priorities.

Our conclusions? First, you should be invested with an investment management firm and try for an equity-like return. And second, pick an investment management firm with an emphasis on investment advice and counseling (see Form 13F), who can also provide other financial services.

We illustrated in a year ago’s newsletter,[2] the US economy is a powerful engine for both domestic and world-wide economic growth. The US economy has recently received the stimulus of a growth-oriented revision to the US tax code. While Woodstock may not match the more speculative returns that will appear over the next few years in certain areas, our goal is to capture an equity-like return for our clients. We hope that you are as proud of your choice of Woodstock as we are of our service to you. The next few years should be multi-generational, economic fun for us all.

We know that you are the most valuable business development tool that we have. Your referral of a friend, colleague or family member to us is the most important way that we grow.

We thank you for your support and want you to know that we are dedicated to serving your best interest.

William H. Darling, Chairman & President

Adrian G. Davies, Executive Vice President

_________________________________________________

[1] Of course, bonds held to maturity return their face value.

[2] Winter 2017