The S&P 500 Index returned 28.7% in 2021, following a 18.4% return in 2020, and a 31.5% return in 2019. Observers would be forgiven for not associating any of these returns with a two-year global pandemic. The index has in fact compounded at a 16.6% rate over the last 10 years. Equity investors have rarely had such excellent long-term returns. Last year, economic fundamentals were excellent too, with US GDP expanding 5.7% in real terms, surpassing its pre-pandemic size on a seasonally adjusted basis in the second quarter of 2021. S&P 500 Index earnings fell 13.9% in 2020 before rebounding an estimated 46% last year. The economic expansion and earnings rebound have been greatly helped by monetary and fiscal stimulus.

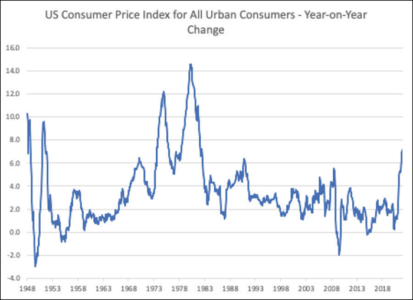

Perplexingly, financial markets don’t seem to care that inflation has been rising, reaching 7.0% year-over-year in December (as measured by the Consumer Price Index or CPI), the fastest rate in almost 40 years (see Figure 1). The core CPI (excluding food and energy) was up 5.5 percent. Inflation has accelerated in other countries, but not to the extent it has in the US. The 10-year US Treasury yield finished 2021 at 1.51%, and most bond yields are well below the rate of inflation, suggesting that bond holders will receive negative returns after taking inflation into account. Low bond yields reflect how loose monetary policy has affected the financial markets, but these yields can be justified if inflation falls. Indeed, inflation seems likely to fall considering it has been triggered by three forces brought about by the pandemic: fiscal stimulus, supply-demand imbalances, and monetary policy. Despite the temporary nature of these drivers however, inflation could very well linger. The Federal Reserve is trying to make sure that does not happen.

Figure 1

Source: Federal Reserve Bank of St. Louis (Federal Reserve Economic Data)

Three Drivers of Inflation

During the pandemic and its aftermath, the federal government flooded our $22 trillion economy with nearly $6 trillion in stimulus spending. The Covid-19 recession was unique in that while US GDP dropped, personal income increased due to government programs including stimulus checks, supplemental unemployment insurance, and emergency rental assistance. These fillips succeeded in reviving the economy, and have arguably been too successful, contributing to inflation. They were always solutions to a temporary problem.

It’s hard to determine the extent to which the stimulus funds have worked their way through the US economic python. Most of the funds have been distributed through direct transfers; other funds remain in government accounts yet to be spent. Beyond government coffers, the spending has a multiplier effect as it ripples through the economy: Person A’s spending becomes Person B’s income, which is then spent generating income for Person C, and so on. Despite this multiplier effect, we cannot borrow and spend our way to prosperity. Such a proposal would require ever-increasing amounts of borrowing — debt holders would eventually lose confidence in our government’s ability to repay. The stimulus ripples will fade, and the US government seems unlikely to pass additional large spending bills at this point.

With the help of federal largesse, demand for goods and services has recovered much faster than supply. Reluctant to spend on restaurants, travel, and live entertainment, consumers channeled their financial resources into their homes, cars, and consumer electronics. At the same time, business managers, expecting the Covid-19 recession to resemble the 2008-2009 recession, scaled back capacity and were caught off guard by the strong recovery in demand that ensued. Supply of many services has been further constrained because people have left the workforce, either because of Covid-19 or just because they have the financial means to do so. A number of choke points have appeared in supply chains, semiconductor production being one.

A queue of over a hundred container ships outside the ports of Los Angeles and Long Beach is another often-cited example of supply chain constraints.[1] While the pandemic has limited supply chain throughput, the shipping queue also reflects the ports’ challenges dealing with record volumes of containers. Container shipments through the ports of Los Angeles and Long Beach, responsible for 40% of the nation’s total, grew 17.9% in 2021, accelerating from 1.9% growth in 2020.[2]

Monetary policy is a third factor driving inflation higher. The Fed increased the size of its balance sheet by $3.3 trillion since the beginning of the pandemic by buying bonds, and in so doing has helped expand the nation’s money supply (M2) by some $6.2 trillion, or 39.8 percent. With more dollars available, each dollar is worth less. Prices of goods and services have been bid up. Asset prices have also been bid up, helping Woodstock’s clients.

Inflation May Be Persistent

Expecting inflation to peak in the summer of 2021, the Fed’s Federal Open Market Committee (FOMC) members described inflation as “transitory” and were initially reluctant to change monetary policy. Frankly, we (I) thought inflation was peaking too. As the pandemic persisted longer than expected, extended by the Delta and Omicron variants, the Fed continued to buy bonds. The variant waves further prolonged supply-demand imbalances and compounded “transitory” inflation.

We expect that there will be additional Covid-19 variants, but we are hopeful that the US is learning to live with the disease. Each successive variant wave has been less detrimental to economic activity. Omicron is milder than prior variants, and with the help of vaccines we ought to be approaching herd immunity. We are hopeful that new variants won’t develop in ways that cause further humanitarian disaster or greater economic disruption. We expect supply chain bottlenecks to get resolved, and that both fiscal and monetary support will recede. Given these expectations, inflation could peak in the first half of 2022 when we anniversary the price increases of early 2021.

How fast inflation retreats is another matter. Our major trading partners may take a little longer to normalize their economies. The forces that triggered inflation may not be symmetrical in pushing down inflation as fast as they drove it up. Inflation has its own inertia: if everyone expects inflation to rise, they will demand higher prices. Companies will keep raising prices as long as they can get away with it, particularly when costs are rising and everyone else is raising prices.

The tight labor market is a critical factor constraining the supply of goods and services, and pressuring wages. The unemployment rate fell to 3.9% in December, although this statistic does not include people who have stopped looking for work. There are still some 3.6 million fewer people in the workforce than before the pandemic. Some have permanently retired. Some 70 million baby boomers started turning 65 in 2011. Seeing how many people return to the workforce may be critical to keeping wages — and therefore inflationary pressures — down.

Looking at the components of the CPI, inflation has broadened out, with more than 80% of component prices above their 5-year average.[3] This does not bode well for inflation dissipating quickly. The “shelter” component of the CPI, which accounts for almost a third of the overall index, was up 4.1% in December 2021. Even at its highest rate since 2007, this component is helping to keep the broader CPI down. Because rents are repriced as they come up for renewal, realized rates lag spot market rates. One study suggested this component of CPI could be running at 6%-7% by next summer, contributing an additional 0.5 percentage points to the headline number.[4] Rent prices tend to follow home prices, which by some accounts have been rising at double-digit rates.[5]

How Much Will the Fed Tighten?

Even if the pressures that created inflation subside, the Fed needs to break inflation’s self-perpetuating inertia by taking an assertive role. In November 2021, FOMC members agreed to taper their program of bond purchases, and in December, they accelerated their schedule. The FOMC further publicized expectations they will raise interest rates three times in 2022, albeit from near zero, and acknowledged they are considering shrinking their balance sheet by allowing the Fed’s bond holdings to mature without replacing them.

We can be hopeful that inflation goes back down without causing a recession. Higher interest rates may have only a modest impact in the near term, enabling the economy to remain strong for another year or longer. Seven-percent inflation could itself start to crimp real economic activity. Increasingly tighter monetary policy will eventually slow economic growth. Both the extent to which monetary policy impacts the economy and the duration over which it plays out are difficult even for the Fed to gauge. Because it can take 12-24 months before the full effects of tightening are felt, the FOMC runs risks of both undershooting and overshooting its policy objectives. Undershooting would allow inflation to stay hot; overshooting would drive the economy into a recession. The Fed does not have a good track record of landing the economy softly. The monetary tightening cycles from 1999-2000 and from 2004-2006 both ended in recessions.

Some investors have the misguided impression that the Fed will use monetary policy to support the stock market. In the 1990s, this interpretation of policy was referred to as the “Greenspan Put.” The Fed’s two objectives are to control inflation and to try to maximize employment. Boosting asset prices is one of the mechanisms by which the Fed has been able to stimulate the economy. The Fed is not interested in stimulating the economy as long as it is primarily focused on fighting inflation.

We Are Benefitting from Strong GDP Growth

The US economy grew at its fastest rate in 37 years in 2021. Greater inflationary pressures are a consequence of stronger economic growth. The critical questions for the inflation outlook are: (1) how much longer will federal stimulus continue to spur consumption; (2) for how long will the pandemic continue to disrupt aggregate supply; (3) how many people will return to the workforce after the pandemic; and (4) how much will monetary tightening constrain demand?

For 2022, we are hopeful that we will put the Covid-19 pandemic behind us and solve our supply chain problems, unlocking further growth. Business capital spending to address capacity bottlenecks and to improve productivity will drive some economic growth. Even so, growth is likely to moderate from its torrid 5.7% pace, with substantial headwinds stemming from the withdrawal of fiscal and monetary support. Accelerating growth overseas could to some degree offset slowing growth here. While we are optimistic that inflation will moderate, we are concerned it will do so at an attenuated pace, coupled with risks that the Fed may undershoot or overshoot its monetary tightening. Given the uncertainties, 2022 could be a volatile year.

We may make slight changes to your portfolios based on your financial needs, your risk tolerance, and the outlook for individual stocks. From the standpoint of positioning investment portfolios, it would certainly be nice to know the timing and extent of the economic cycle, but we do not recommend making wholesale changes to portfolios based on economic forecasts. In a recent article, Bloomberg columnist Mohamed El-Erian pointed out that even if we had known a year ago that inflation would spike to 7%, and virtually no one did, we probably would not have guessed that the stock market would be up 28.7 percent. The juxtaposition of these outcomes provides an excellent example of why we should remain humble when trying to predict financial markets.[6]

Large portfolio changes would of course generate high tax bills in taxable accounts. In the absence of excellent foresight, we do our best to construct diversified, all-weather portfolios that are prepared for markets behaving like bad winter storms. High-quality companies have pricing power and will figure out how best to manage through these challenges. Stocks generally go up over time, even if the pathway is unpredictable. The only way to benefit from compounding returns is to stay invested in the market. If you have any questions about how the information discussed here pertains to your investments, please call either me or your portfolio manager.

Adrian Davies, President