Stocks finished 2023 with a strong +26.3% return for the year. Technology was the sector leader, up +57.8%. These strong returns come rebounding from a difficult 2022, when the broader S&P 500 Index was down -18.1% and technology stocks were down -28.2 percent. Inflation, which has been generally falling since the Consumer Price Index (CPI) reached its recent apex of 8.9% in June 2022, has been one of the stock market’s most pressing concerns. The CPI started 2023 at a +6.4% y/y, and closed out December 2023 growing +3.3%, approaching the Federal Reserve’s target of 2.0 percent. With hindsight, the inflation wave, primarily caused by the aftereffects of Covid-19—supply chain issues and excessive government spending—looks fairly steady and predictable.

The Economy Is Slowing—What’s Not to Like?

Remarkably, the economy has continued to grow at a healthy pace even as inflation has come down. The Fed’s 5.25 percentage point increase in the federal funds rate over the last two years has had surprisingly little effect on either consumer spending or the job market. US real GDP grew 2.5% in 2023, a much stronger level than previously expected. With such healthy economic growth overall, it’s unclear what role the Fed has had, if any, in suppressing inflation after it kept monetary policy exceptionally easy for too long.

GDP growth is expected to slow to a 1.3% rate this year, according to a Bloomberg survey of economists. Higher mortgage rates have slowed the market for existing home sales. As fixed-rate loans held by individuals, businesses, and the government come due, they will need to be refinanced at higher rates, squeezing budgets and dampening profitability. Please see our Summer 2023 QMP article, “An Unusually Strong Recovery” for a discussion of why consumer spending is due to slow further. Marginally profitable companies, which have been sustained on cheap funding, will need to be either restructured or sold. The private equity industry, as mentioned in our Page 1 letter this issue, relies heavily on debt to finance its investments, and is facing strong headwinds as portfolio companies refinance their debts.

There is also a reckoning taking place in commercial real estate, the price of which depends heavily on the cost of funds. While property owners and private equity managers are doing what they can to defer the reckoning, rate cuts from here probably won’t be enough to stop some upheaval in these industries.

Heavy government spending is providing support to the economy, accounting for 24% of US GDP in 2023.[1] The federal budget deficit last year was 5.9% of GDP. This level does not seem to be sustainable, likely leading to an excessive debt burden and very possibly higher inflation. A shrinking deficit is contractionary, so fiscal policy is more likely to become a headwind to economic growth, although neither of the leading presidential candidates are paragons of fiscal opprobrium.

Slower growth should help dampen inflationary pressures. The CPI is forecast to fall from 3.3% at year-end 2023 to 2.6% by year-end 2024, according to the Bloomberg survey mentioned just above. With the threat from inflation diminishing, Fed officials have indicated they expect to start cutting rates, a positive for both stocks and bonds. The capital markets are generally more sensitive to monetary policy than to changes in the economy. So when the Fed reacts to changes in economic conditions by adjusting monetary policy, markets are more focused on the monetary response.

Bad economic news, such as higher unemployment or lower consumer spending, can be good news for the markets, but there comes a point at which bad news hurts companies’ earnings power and stock prices. Bad news can just be bad news. Higher inflation is fairly unambiguously bad news for the markets, since the Fed needs to respond to inflation by tightening monetary policy. The opposite conditions are present today: inflation is retreating without much evident economic softness.

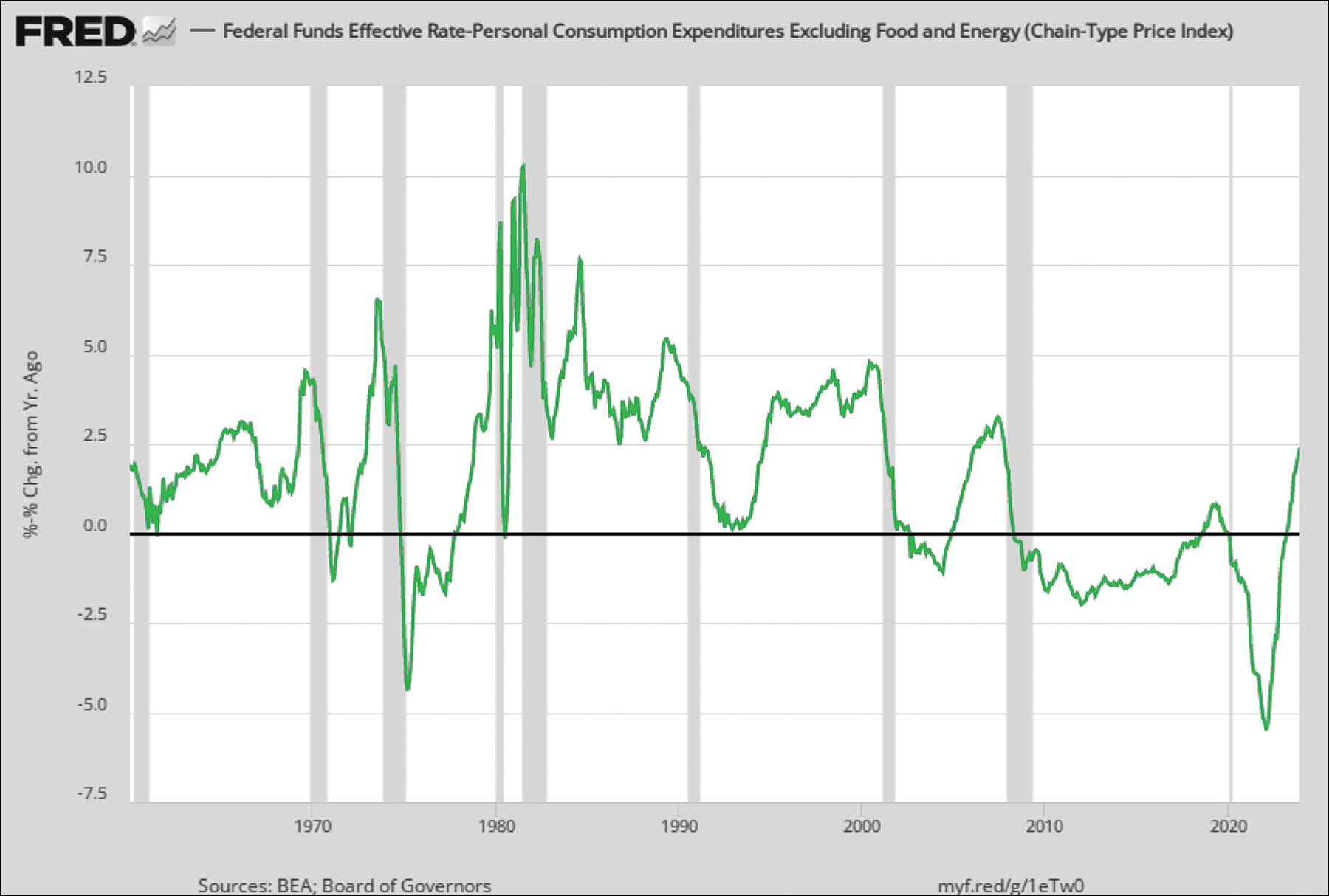

Having been slow to act when inflation first emerged, Fed officials don’t want to get caught out a second time, being irresponsive when inflation is in retreat. A look at real interest rates, nominal rates minus inflation, suggests the Fed should cut. Falling inflation means real rates have been rising (see Figure 1). Since the Fed doesn’t think rates should be rising at this point in the economic cycle, they are considering cutting the federal funds rate in order to stabilize real rates, but they need to be reasonably confident inflation will stay low. Rate cuts are the Fed’s main tool to stimulate the economy—they need to be cautious when expending this limited resource. It’s hard to see the Fed using much ammunition when the unemployment rate is as low as 3.7% and wage inflation is still up 4.1% y/y, hotter than what officials are comfortable with. They should be, and probably are, looking to the next year and beyond when considering policy adjustments.

Figure 1 – Real Interest Rates Are Rising

Source: St. Louis Federal Reserve

With Federal Reserve Chairman Jerome Powell indicating a bias in December towards lowering interest rates, the risk that tight monetary policy might cause a recession has diminished. Many prognosticators believe the worst is over, but as we and others have cautioned before, monetary policy works with long and variable lags. If interest rate hikes have not had all that much effect slowing the economy—at least yet—we shouldn’t expect rate cuts to be all that stimulative. Monetary easing would also be subject to lag effects.

Perceiving the tight job market conditions, companies have been described as “hoarding labor.” But market psychology can change quickly as general perceptions evolve, particularly when demand for companies’ products and services starts to fall off. The unemployment rate tends to fall gradually but rise quickly. And since economic statistics are often revised after their initial release, we may only be able to identify turning points well after the fact. Inflation and interest rates could end up falling much further—that scenario is consistent with higher unemployment and a recession. However, it’s very rare to get a recession in an election year.

Where Will Interest Rates Settle Out?

Investors don’t seem particularly concerned about the possibility of inflation returning. Instead, they appear to be assuming we will return to the inflation and monetary backdrop prior to the Covid-19 pandemic, when the Fed had difficulty keeping inflation up to its target level of 2.0 percent. Inflation may decline further in the near term, but that does not mean either inflation or interest rates will stabilize in the ranges we saw during this prior period. The Fed held the fed funds rate between 0.0% and 0.25% from 2008 through 2015, raising the target range gradually after that until it reached 2.25% to 2.50% in early 2019. The current fed funds rate range of 5.25%-5.50% is high relative to recent history, but the range is not high relative to a longer history.

If the economic backdrop going forward does not resemble the backdrop of the last twenty years, we should not expect rates to go back to where they were. From 2000 through 2019, the outsourcing of manufacturing to China was a major deflationary force. Not only were manufacturing costs lower in China, but millions of US workers in the manufacturing sector lost their jobs. There is an effort to reverse the outsourcing trend now, with governments and businesses reconfiguring supply lines, not to optimize cost structures, but to assure resilience in the face of greater geopolitical tensions.

Companies are bringing manufacturing jobs back to the US or at least “near-shoring” them to strategically more compatible countries. If outsourcing was deflationary, de-globalization and near-shoring look to be more inflationary. Secondly, the baby boomer generation is retiring. Paring back a meaningful part of the skilled workforce should be inflationary. Other pressures that could drive inflation higher relative to this prior period include: greater organized labor activity, minimum wage increases, geopolitical tensions, restrictions on global trade, shipping constraints, the rebuilding of energy infrastructure, and continued deficit spending. The record sums the US government is borrowing could also drive real rates higher.

Some are hopeful that strong productivity improvements can offset some or all of these inflationary pressures. Productivity would likely also contribute to corporate earnings growth and help support share prices. Artificial intelligence (AI) technology is often cited as a key driver of the next wave of productivity growth, and we agree it will have a profound effect on the economy. However, companies are likely to use efficiency gains to lay off workers, leading to some amount of economic dislocation. AI and greater productivity will create new jobs, but it may take time for dislocated workers to find new opportunities. More importantly, the economic forces listed above which are likely to drive inflation higher are inflationary precisely because they reduce productivity. These forces could be at least as strong as the forces generating productivity gains. Greater productivity may lessen the impact of inflation, but probably doesn’t eliminate the threat.

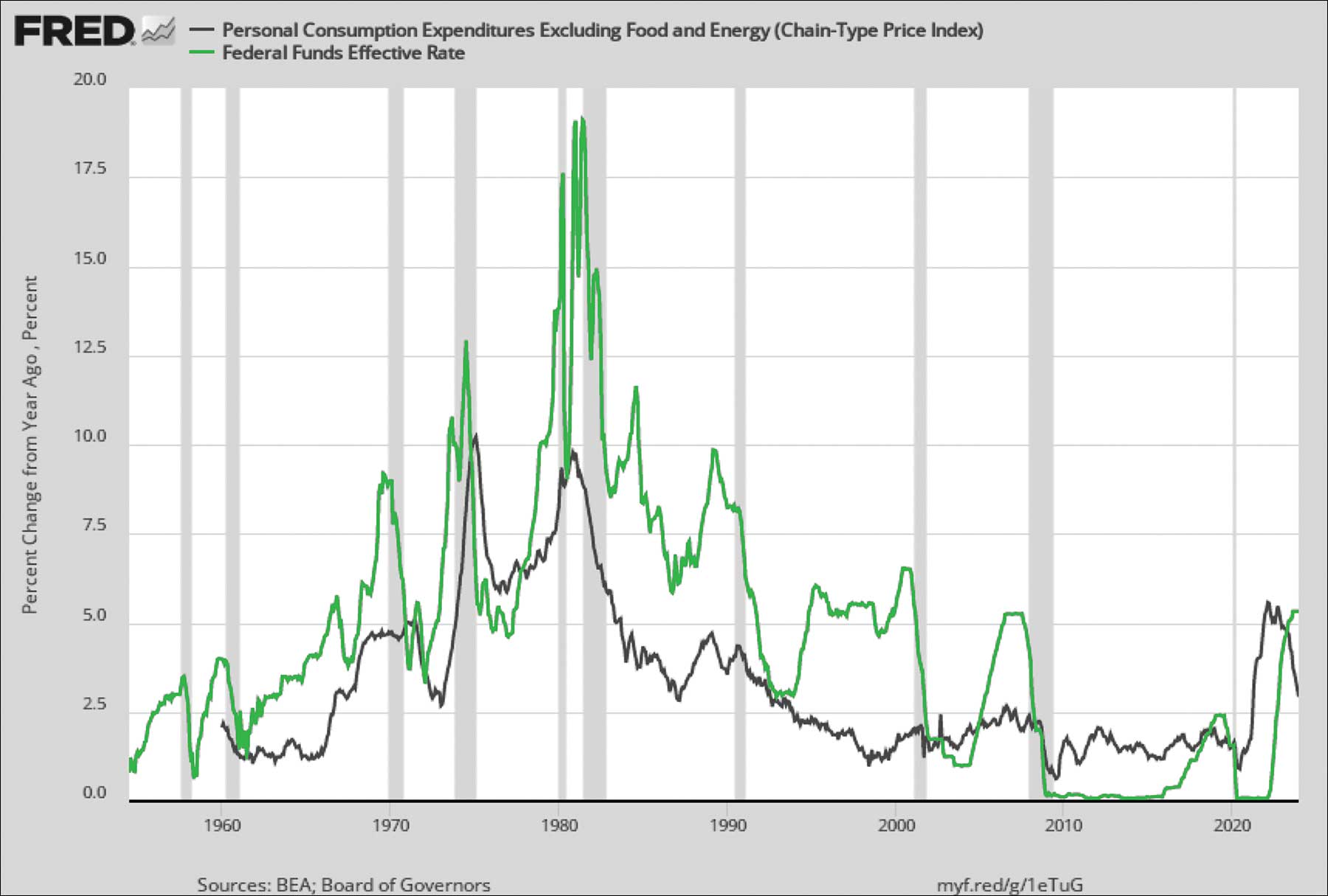

There were significant inflationary peaks in 1948, 1951, 1970, 1974, and 1980. One could include 1989, 1990, and 2008 if one were to include any CPI reading over 5.0 percent. Stinging from the inflation waves in the 1970s and 1980, the Fed held the fed funds rate well above the CPI through most of the 1980s and 1990s (see Figure 2). While the circumstances surrounding the current wave are unique, one might expect Fed officials to harbor some residual caution about lowering rates too much. We may have entered a period when our economy is more vulnerable to inflation than it has been for a while. If inflation were to rebound in 2024 or later, it would probably upset markets.

Figure 2 – The Fed Has Mostly Kept the Fed Funds Rate Above Inflation

Source: St. Louis Federal Reserve

Stocks and Bonds Going Forward

With minimal risk, money market funds offer a very competitive, roughly 5% return. But in so far as the Fed has indicated they are likely to cut rates, the current high rates available on cash will decline. Despite current trends indicating inflation may be heading lower over the near term, broader economic conditions suggest inflation and interest rates will probably not settle back to the ranges they traded in immediately preceding the pandemic. Depending on how far rates fall, investors may reallocate money market funds into other asset classes. It may make sense to lock in attractive interest rates by buying short-term or intermediate-term bonds. Our concerns about recurring inflationary pressures suggest now may not be the best time to buy long-term bonds—longer term bonds are not pricing in higher levels of inflation.

Are falling rates a reason to buy stocks?

Investors have been piling into stocks in anticipation of rates being cut, so much optimism seems to be already factored into stock prices here. The S&P 500 Index trading at 20.0 times 2024 forecast earnings seems to be reflective of an ebullient mood. The S&P 500 Index’s earnings yield, the reciprocal of its price-to-earnings ratio, is currently 5.0%, and can more readily be compared to the 10-year US Treasury yield of about 4.0% and cash at just over 5.0 percent. Long-term bonds yield less than cash despite greater risk—that’s another issue. One can justify stocks’ earnings yields being below bond yields on the basis that earnings, unlike bond coupon payments, tend to grow over time — investors are willing to accept lower current yield in anticipation of future growth.

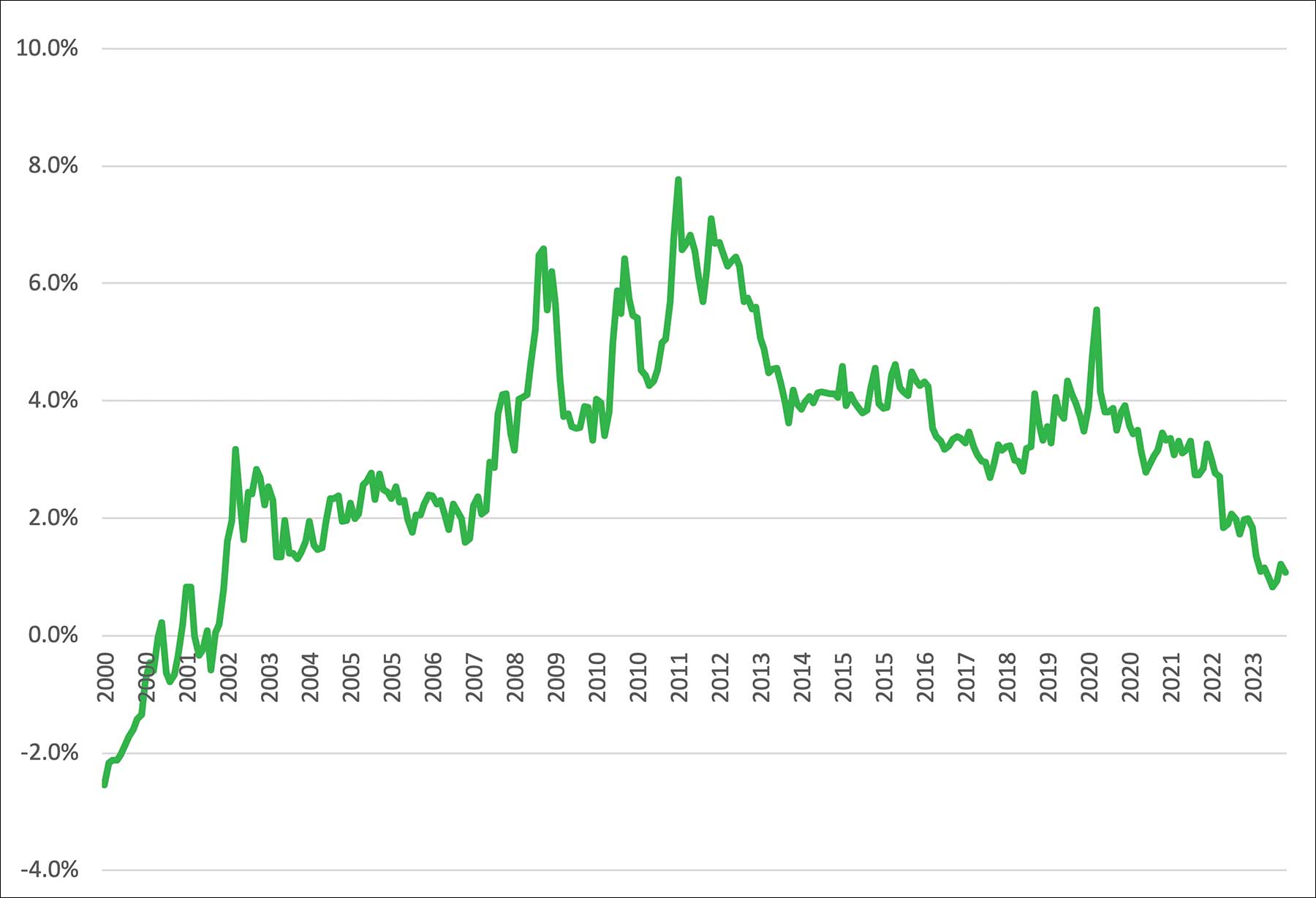

Historically however, the S&P 500 earnings yield has traded higher than the 10-year US Treasury yield, reflecting the greater risk of stock investment. The stock market’s equity risk premium (ERP) is its earnings yield above (minus) the risk-free yield, represented here by the 10-year US Treasury yield, and it’s usually a positive number (see Figure 3). Over the last 24 years, the S&P 500 has traded at a median +3.3 percentage points ERP to the 10-year Treasury, as compared with just one percentage point today. Investors seem to be crowing not only that inflation has been vanquished, but that earnings growth will be robust over a multiyear period.

Figure 3 – The Equity Risk Premium Is Historically Low

Source: FactSet data

Analysts expect S&P 500 Index earnings to grow an unusually hearty 11% this year. This growth seems inconsistent with the “soft landing” scenario whereby GDP growth slows to a modest pace. Investors may not maintain the same level of optimism throughout the year. Growth overseas could always improve, but at the time of this writing, the European and Chinese economies aren’t in positions to drive much global economic growth.

Stocks are ever precariously balanced between the risks of higher capital costs and slower growth. Stock prices dip whenever one of these fears spreads. However, and despite investors’ obsession with the seven largest capitalization stocks, the market always offers a great dispersion of opportunities. Even if the stock market is expensive overall, we believe there are still attractive investment opportunities to be found.

The recent bout of high inflation has reinforced our view that clients are well served by holding high-quality stocks. We believe high-quality stocks do well under other market conditions as well. Having the confidence to hold them through these difficult periods helps to generate strong returns precisely because the times when stocks are difficult to hold often provide the best returns. We recommend using any sell-off as an opportunity to add to positions.

Adrian G. Davies, President

1 Congressional Budget Office, Budget and Economic Data, 10-year Budget Projections, May 2023, https://www.cbo.gov/data/budget-economic-data.