Although high inflation, high interest rates and incessant recession predictions have cast a shadow over the economy the past year, a sudden increase in innovation has provided some much-needed hope and a glimpse into a brighter future. Recent advancements in artificial intelligence and weight-loss pharmaceuticals threaten to shake up their respective industries. While the major players—Microsoft, Alphabet and Eli Lilly—will all likely benefit, these innovations will also provide an opportunity for new, smaller companies that can lead across these technological changes.

Woodstock Corporation primarily invests in tried-and-true companies that combine a track record of earnings growth and solid balance sheets. Many of these companies will certainly benefit from the above-mentioned innovations—either directly or indirectly. Additionally, Woodstock Corporation implements two strategies across separately managed accounts with investment objectives that could provide exposure to these breakthroughs: Technology Strategy and Healthcare & Biosciences Strategy. The smaller companies that these strategies

pinpoint to invest in will, in many cases, have a higher degree of risk than normal, but will offer the chance at a higher return. As the business landscape changes, these companies could be well positioned to move higher with it. (Woodstock also implements an Energy Strategy; see below.)

While the advancements in artificial intelligence and weight-loss drugs will have far-reaching implications across sectors and industries, it’s always wise to consider Amara’s Law:[1] “We tend to overestimate the impact of technology in the short run and underestimate the effect in the long run.” In the meantime, let’s examine how each sector could evolve.

Woodstock’s Sector Strategies

Starting in 2009 three investment managers at Woodstock began managing what we call the strategies in three sectors: energy, healthcare/biosciences, and technology. The companies to be invested in would be smaller and, potentially, more volatile than companies that make up Woodstock’s Monitor List. The Monitor List is the approved list of approximately 100 companies that Woodstock’s investment managers place in client accounts. Each strategy would hold ten to sixteen stocks within the sector definition. Our Global Investment Performance Standard (GIPS) reporting includes three composites—Growth, Growth & Income, and Conservative—and the three strategies to make up six components of our GIPS reporting.

At the present time, the strategies have the focus described below.

The Energy Strategy is a portfolio diversified across energy subsector niches of integrated international oil, exploration and production, refining and marketing, onshore drilling, oilfield service, and another category that offers exposure to gold and copper, a critical material in the energy transition. Undervalued and inflation-protected yield, net asset value growth potential, leveraged beneficiaries of higher energy commodity prices and a lower US dollar are investment themes expressed in various holdings. The Energy Strategy portfolio yields 2.2% and trades at 9x forward earnings per share (EPS). Currently, there are sixteen holdings in the portfolio; over its fourteen-year existence, the number of holdings has ranged from ten to sixteen.

The Healthcare & Biosciences Strategy primarily focuses on late-stage clinical and commercial bioscience companies working on therapeutics with substantial commercial potential. It also looks at medical technologies addressing diagnostic and treatment administration. Major areas of attention include neurology, nephrology, oncology and gene therapy.

The Technology Strategy invests in information technology companies. The portfolio includes companies exposed to the following technology themes: consumer internet, digital advertising and entertainment, software, information management, cloud computing, artificial intelligence, cybersecurity, network management, semiconductors, hardware, and technology consulting.

An important aspect of Woodstock’s strategies is that they are not “pooled investment vehicles.” Each investor has a separate account in each, or only one, strategy with a proportionate number of shares of each investment for the strategy.

AI Disrupts Tech Sector and More

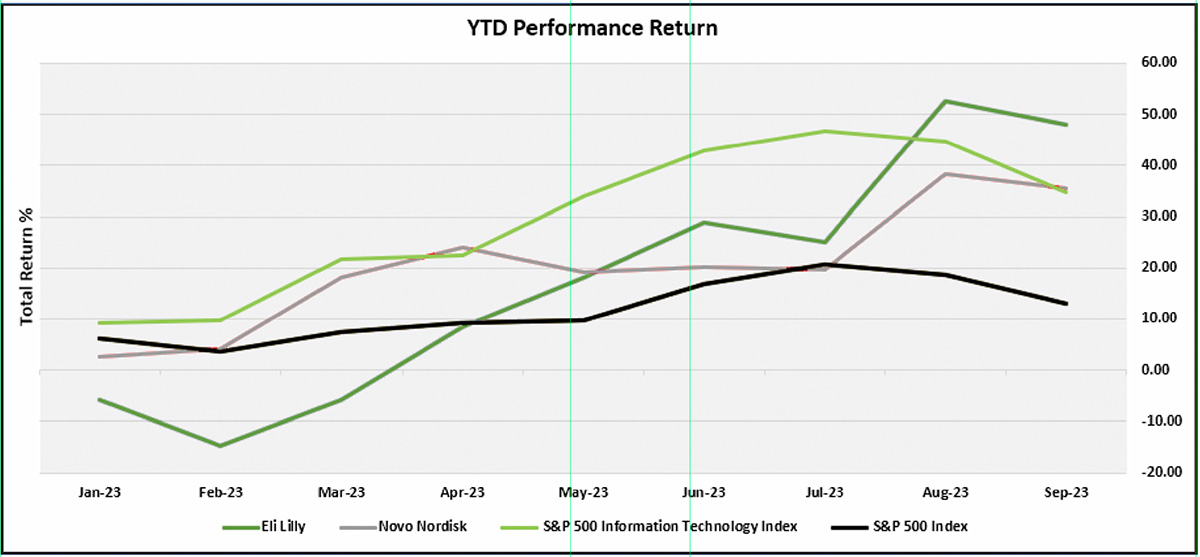

Since the introduction of ChatGPT in November 2022, artificial intelligence has received an enormous amount of attention both in the mainstream and financial media. All this attention has helped move the S&P 500 technology sector up almost 40% year to date despite higher interest rates, which typically weigh down technology stocks, since profits are usually further out in the future. The expectation is that artificial intelligence’s large language models will make it easier for people and businesses to find information, create content and analyze data. Large data sets will now be simpler to access and understand for everyone.

The applications of artificial intelligence will be wide ranging, from the likely disruption of internet search to companies being able to convert their large amounts of existing data into actionable decisions in a far timelier manner. Disease diagnosis, drug discovery, forecasting, legal contract writing, job application screening, and customer feedback analysis are all functions that artificial intelligence could upend. The so-called “pick-and-shovel” businesses, like microchip maker NVIDIA and its industry-leading graphics processor, have been the early winners. Beyond the chipmakers, it’s likely that software companies, cloud-computing service providers and the usual mega-caps will be in the mix to capitalize on this shift. This is where opportunity exists for both big and small companies.

However, challenges lie ahead for artificial intelligence. None other than Tesla CEO Elon Musk called for restraint in development back in March 2023. Musk was among a group of industry leaders that penned a letter requesting a pause. They believe “powerful AI systems should be developed only once we are confident that their effects will be positive and their risks will be minimal.”[2] Also, regulators are starting to weigh in on privacy concerns and copyright infringements.

Additionally, the implications of artificial intelligence on the workforce are hard to ignore. Technological advances have mostly resulted in net positive jobs looking back hundreds of years across all fields. At the peak in the 1950s, almost 350,000 telephone switchboard operators were employed.[3] Those jobs were obviously replaced by technology and then some, but this time could be different if the disruption happens too quickly. None of these concerns should be completely dismissed, but they are unlikely to stand in the way of progress. Many businesses now consider themselves “technology” companies because they implement technology others sell. Eventually, most will consider themselves “artificial intelligence” companies.

New Drugs Impact Healthcare and Other Industries

The “mega” theme in this space involves the recent development of weight-loss drugs, GLP-1s, which work by suppressing patients’ appetites. The potential impact here is huge, given that 40% of US adults are considered obese.[4] These drugs could improve the lives of around 85 million Americans with pre-existing cardiovascular disease.[5]

Competition is sure to follow, but Novo Nordisk and Eli Lilly are the clear leaders for now. Novo already has two FDA-approved drugs for Type 2 diabetes and weight loss—Ozempic and Wegovy. Lilly has an FDA-approved drug for Type 2 diabetes with a weight-loss drug, Mounjaro, expected to be approved by the end of this year. And if potentially helping tens of millions of

Americans lose weight wasn’t enough, these drugs could reduce strokes, heart attacks and sleep apnea. These are the market-changing developments that will create winners and losers in this space. (See Figure 1.)

Figure 1.

Like artificial intelligence, the GLP-1 impact is expected to be far reaching. Medical-device stocks have been hard-hit since the rise of appetite-suppressing drugs, as healthier people require fewer procedures and treatments. For example, Intuitive Surgical, a surgical robot maker, has seen weaker demand for bariatric surgery. The ripple effects are starting to extend much further out. Walmart reported a “slight pullback in the overall basket” of food purchases and snack makers are now studying the potential effect these drugs will have. On the good-for-business side, more health-conscious people will want to monitor their overall health, including glucose levels, blood pressure and weight. Apparel will also likely benefit as people lose weight and require new clothes, and even the airlines. One analyst projected United Airlines would save $80 million annually if the average passenger lost 10 pounds.[6]

Also, like artificial intelligence, GLP-1s still have hurdles to clear. These are not the first drugs to make grand promises about weight loss and the end of obesity. Side effects include nausea, vomiting, intestinal blockages and even stomach paralysis. Additionally, there are open questions on how long the drugs will need to be administered and if insurance can and will cover them. All valid concerns, but if the drugs work as hoped without the nastier side effects, then resolutions will be found to these open questions and a different healthcare sector will emerge.

Change is coming directly for technology and healthcare and indirectly for the remaining nine Global Industry Classification Standard (GICS) sectors.7 We are still in the early innings and the endgame is very much unknown. There are sure to be stock price changes that are overblown, both up and down, as investors try to understand the impact of the new technologies, especially in the areas downstream where the secondary effects are more difficult to fully appreciate. Bubble-like behavior may arise, much like in the early days of cloud-computing companies. As is often the case, the speed and scope of these changes will be difficult to predict, but big companies with deep pockets and small companies that are nimble and adaptable are in the best positions to succeed. “Change is inevitable. Growth is optional.”[8]

David Layden, Portfolio Manager

Disclosure: Woodstock Corporation

(“Woodstock”) is a Massachusetts corporation headquartered in Boston Massachusetts.

Woodstock is registered as an investment adviser with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration with the SEC does not imply any level of skill or training. Woodstock claims compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. GIPS® are a set of standardized, industry-wide ethical principles that provide investment firms with guidance on calculating and reporting their investment results to prospective clients to ensure fair representation and full disclosure of an investment firm’s performance history.

Certain information contained herein has been obtained from third party sources and such information has not been independently verified by Woodstock. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by Woodstock or any other person. While such sources are believed to be reliable, Woodstock does not assume any responsibility for the accuracy or completeness of such information. Woodstock does not undertake any obligation to update the information contained herein as of any future date.

This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Specific investments described herein do not represent all investment decisions made by Woodstock. The reader should not assume that securities identified and discussed were or will be profitable. Specific investment advice references provided herein are for illustrative purposes only and are not necessarily representative of investments that will be made in the future. A complete list of all securities recommended by Woodstock in the preceding year, a full compliant GIPS Composite Report, and the list of composite descriptions are available upon request from Woodstock.

Past performance is not indicative of future results.

______________________________________

1 After the late Roy Amara, American scientist, futurist, and president of the Institute for the Future.

2 “Elon Musk and Others Urge AI Pause, Citing ‘Risks to Society,’” Reuters, March 29, 2023.

3 David A. Price, “Goodbye, Operator,” Econ Focus, Federal Reserve Bank of Richmond.

4 Josh Nathan-Kazis, “How Ozempic and Wegovy Could Break the Healthcare System,” Barron’s, 09/21/2023.

5 Lauren R. Rublin, “12 Stock Picks From Our Healthcare Roundtable Pros. Weight Loss Isn’t the Only Big Deal in Medicine,” Barron’s, 10/07/2023.

6 Daniel Gilbert and Laura Reiley, “Food, Clothing, Airlines: Ozempic Is Coming for These Industries and More: Analysts Predict Weight Loss Drugs Will Have Ripples across Many Industries,” Washington Post, 10/09/2023.

7 MSCI and S&P Dow Jones Indices developed the GICS classification standard to provide investors with consistent and exhaustive industry definitions.

8 John C. Maxwell