Woodstock Quarterly Newsletter / Q1 2020

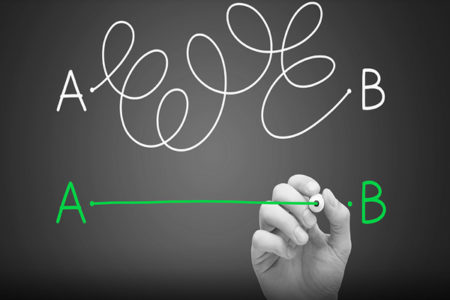

One of the great desktop admonitions is “eschew obfuscation”. We interpret that to be a message both to cut needless or unhelpful complexity and to keep it simple. In that spirit, a recent address caught our eye. As described in a December 2019 address by the director of the division of investment management at the SEC[1], the regulatory battlefield includes, as general categories, let alone specific sub-groups: finalized rulings, proposed rulings, exemptive orders, and outreach initiatives.

There were eleven sub-groups in these four categories that were discussed. Through the seven pages of the address, these quotes from the speech jumped out, as noteworthy to us with our comments following: “non-transparent ETFs…which will not publish their portfolio holdings every day” (Because the ETFs will still trade daily, there is a concern about sufficient daily information to determine value as there should be.); “effectively leverage and empower the board” (This relates to derivatives disclosure mandated by the SEC. We would capitalize “Board” and hope they understand already what their managers are doing without SEC help.); “potential leverage obtained through derivatives…appears to be subject to little in the way of practical limits” (We believe Warren Buffett called them “weapons of mass destruction”; how about treating them like personal ownership of a bazooka?); “conflict assessment and management of securities lending” (With trading revenue dropping, Boards are looking at expanding other revenue sources such as securities lending and cash management. Of course, these are two areas where problems arose in 2008 as liquidity evaporated and conflicts appeared.). Issues with valuation, Board of Trustees’ or Directors’ understanding, excessive leverage, and conflicts of interest are not fringe issues, which are being raised but not being solved. Complexity is not necessarily a benefit to individual investors, nor is obfuscation a solution.

We did, however, think that one particular question raised in the address rose above the others: Disclosure by investment managers should cover one “simple question…how much of my money is working for me?” Of course, it is not a simple question and goes to the heart of the majority of the financial services industry and fiduciary duty or lack thereof. We’d paraphrase the question as: Where are the customers yachts? Caveat Emptor! These frame the historical tension between buyers and sellers in a market place.

An equity-like return with tax free compounding over the long term is a wonderful thing. The complexity of the majority of the financial services industry will not get it for investors. An individually managed account where you are the owner at an investment manager who owes you a fiduciary duty is probably your best chance. Amazingly that is us.

We know that you are the most valuable business development tool that we have. Your referral of a friend, colleague or family member to us is the most important way that we grow.

We thank you for your support and want you to know that we are dedicated to serving your best interest.

William H. Darling, Chairman & Chief Executive Officer

Adrian G. Davies, President

____________________________________

[1] www.sec.gov/news/speech/blass