Woodstock Quarterly Newsletter / Q2 2020

Market Performance

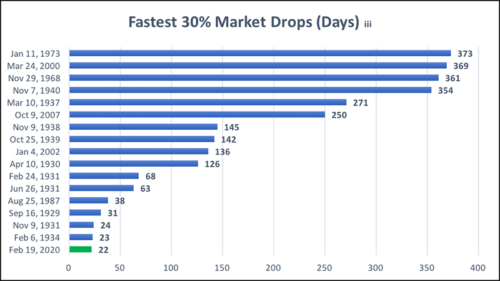

The first quarter of 2020 was a painful reminder that markets don’t always go up. After a near eleven-year bull market run that began March 9, 2009, the S&P 500 Index plunged 33.9% between the market peak on February 19 to the most recent price bottom on March 23.[1] Over this four-and-a-half-week stretch, we saw two of the worst single-day declines since the Great Depression began in 1929, selling off -9.5% on March 12 and -12.0% on March 16.[2] The COVID-19-related uncertainty led to the swiftest market meltdown on record at 22 days.[3] However, the final returns for the quarter weren’t as bad as one might think, due to the positive market returns running up to the peak and the significant 15.7% rebound off the bottom. The S&P 500 Index ended the quarter down -19.5 percent. The tech-heavy Nasdaq Composite Index was off a comparatively better -13.9% and the blue-chip, 30-stock Dow Jones Industrial Average was down slightly worse at -22.6 percent.[4]

Source: Bank of America Global Research

The energy and financial sectors were hardest hit in the quarter, down -51.0% and -32.3%, respectively. The information technology, health care, consumer staples, and utilities sectors were relative outperformers, while still down -12.2%, -13.1%, -13.4% and -14.2%, respectively, this past quarter. Larger companies outperformed small- and mid-sized companies: the small/mid-capitalization Russell 2000 Index was down -30.6 percent. Higher-quality stocks outperformed lower-quality stocks: Standard and Poor’s quality ranking B-rated-or-worse stocks underperformed B+-rated-or-better stocks by 6.5% in Q1. Large-cap US indexes tended to outperform global developed and emerging markets indexes when translated back to US currency: the MSCI EAFE Index was off -22.7% and MSCI Emerging Markets Index was off -23.5% in the quarter. Woodstock portfolios tended to benefit from all of these stock market performance biases through the stock selection and construction of our portfolios that favor large, high-quality US companies that emphasize information technology, health care and consumer staples.[5]

Negative Stimulus and Response

While the past eleven years have not been without some bull-run pauses and a few meaningful corrections along the way, the upward trend has held up as market participants digested and shrugged off risks here and abroad. The full economic impact of the COVID-19 pandemic has been much more difficult to predict, and therefore price. The uncertainty-driven rush to sell hurt more than just stocks, impacting investment-grade corporate bonds (-4.1% for the quarter) in the crushing demand for the safety of cash and liquidity. Long-term US Treasury bonds were a bright spot in the quarter, with a flight to quality driving these assets up 21.5%.[6] The rapid and dramatic market drop experienced in the quarter naturally has people wondering what the shape of the recovery to come will look like. While everyone hopes for a “V-shaped” economic recovery, the recent US stock market rebound is pricing in optimism for a rapid economic recuperation. While only the Nasdaq Composite Index is on its way toward a V-shaped rebound, the S&P 500 Index and Dow Jones Industrial Average are struggling to maintain the positive momentum. With the full weight of the economic impact of the coronavirus yet to be determined, the final recovery paths of the economy and asset prices are anyone’s guess.

As global coronavirus cases surpass 4 million and US cases exceed 1 million, questions about the accuracy of such counts abound, with testing needs overwhelming limited supplies. Virus-protection protocols that began with hand-washing and social distancing have been augmented over the ensuing weeks with mandatory face masks, state-by-state shelter-in-place orders and lock-downs, shuttering of nonessential businesses, and generalized fears that have decimated entire industries, particularly those related to travel, entertainment, non-grocery/non-pharmacy retail and restaurants. The resultant unemployment impact has been catastrophic, seeing roughly 33 million new unemployment claims since mid-March (as of this writing in mid-May). This is an astonishing 20% of the total US employable population.[7]

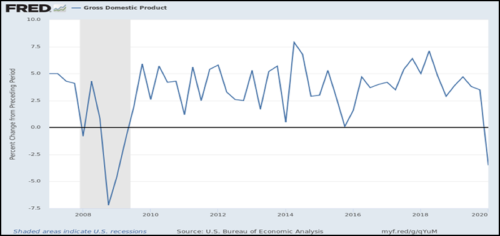

The temporary shuttering of nonessential businesses hurts large and small companies alike. Consumers are taking the brunt of the impact from closed small businesses, unemployment, furloughs, reduced hours and lost wages. This will have the largest impact on the health of the economy. Two-thirds of US GDP is driven by consumer spending. With the services and transportation sectors accounting for 65% of GDP, the economic toll of coronavirus will endure until all sectors can return to full production.[8] Nominal Gross Domestic Product decreased from the prior quarter by a seasonally-adjusted annual rate of -3.5% (real GDP declined -4.8%) in Q1, following three years of quarterly growth above 2.5 percent.[9] This was the first negative GDP “print” (report) since the Great Recession of 2008, perhaps an indicator of things to come.

Source: Federal Reserve Bank of St. Louis

Positive Stimulus and Response

Death tolls from the virus exceed 80,000 in the US, as the global pandemic has taken over 280,000 lives worldwide.[10] With lives hanging in the balance, the hope for a return to normalcy hinges on advances in COVID-19 testing, antibody immunity testing, herd immunity rates, new social distancing and disinfecting requirements, and perhaps most importantly, pharmaceutical development of therapeutic cures and preemptive vaccines. The global pharmaceutical industry mobilization to attack one disease has been unlike anything seen since industrial production response in wartime. Dozens of companies are working on scores of remedy and vaccine candidates. Drug testing and safety protocols, regulatory approvals, and the ramp-up required for manufacturing production will likely delay any treatments or vaccines until perhaps the first half of 2021. However, with the steady stream of positive news on potential cures, markets have responded in kind.

The virus-related and government-mandated economic lockdown has created so much uncertainty around corporate sales and profits that most companies have rescinded any past forecasts of revenue and earnings, and suspended all future guidance. With current estimates of earnings and growth now meaningless, company valuation metrics are specious. Though prices appear attractive relative to pre-February 19 history, most now lack sound estimates to make valuations plausible in the near term. In spite of this, we do our best to divine potential upside and downside scenarios for the companies we own. Taking a longer-term view, we look for attractively valued businesses with sound management teams, competitive products, and strong balance sheets, that have the best chance of weathering this economic storm and outlasting their competitors. From a broader market perspective, the S&P 500 Index was trading on 12-month forward estimated earnings of $177 per share at its February peak, a 19 times forward price/earnings ratio. Since 1946, it has taken two years, on average, to recover an all-time-high after a bear market (though it should be noted that the 2000 and 2008 bear markets took 8 years and 6 years, respectively).[11] We are optimistic that the market index will recover to reflect similar forward earnings estimates and multiples of price/earnings that we experienced before the pandemic in the historical average time frame.

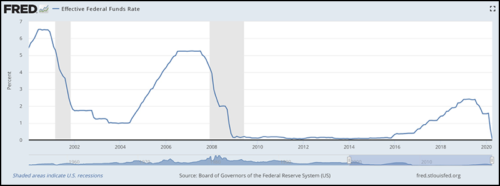

US companies are not in this battle alone, however. The economic stimulus from the federal government has been both colossal and far-reaching. The US Federal Reserve cut interest rates twice in March, by 50 basis points and then by 100 basis points less than two weeks later. The effect was to bring the federal funds rate target to between 0% and 0.25 percent.[12] This allows banks to borrow from the Federal Reserve at exceptionally low rates to provide liquidity to the economy. The Fed has shown a willingness to keep rates low for extended periods of time in order to stimulate economic growth, encouraging borrowing and investing, as evidenced by the pattern of rates following the last recession. The Fed also embarked on quantitative easing (QE) measures, promising purchases of fixed income securities in the open market, and providing bank loans totaling $3 trillion dollars.[13]

Source: Federal Reserve Bank of St. Louis

The US Congress has also enacted a series of bills to provide economic assistance, income security, cheap business lending and outright cash payments to citizens to help people through this crisis. The first bill passed in early March, House Resolution (H.R.) 6074: Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020. Dubbed “Phase 1,” the bill provides $8.3 billion in emergency funding to test, treat, and prevent the spread of COVID-19. Roughly 80% of funds were earmarked for domestic response via the Department of Health and Human Services (HHS), Centers for Disease Control and Prevention (CDC), and state and local health organizations. About 20% of funds went to the US Agency for International Development (USAID) for international assistance.

“Phase 2” legislation came in mid-March. H.R. 6201: Families First Coronavirus Response Act provides funds for expanded unemployment and sick benefits, support for employees missing work due to quarantine, isolation or COVID-19-related care for family members, free coronavirus testing, and nutritional assistance for those with food insecurity. The Congressional Budget Office estimates this act will cost roughly $192 billion, including $95 billion in tax credits.[14]

“Phase 3” legislation has garnered the most press. The Coronavirus Aid, Relief, and Economic Security (CARES) Act is expected to cost $2 trillion. This is the bill that includes $1200 cash payments to individuals who qualify, and $500 per child. It includes the $349 billion Payroll Protection Program (PPP) administered by the Small Business Administration (SBA); expands on the unemployment benefits from “Phase 2”; provides $46 billion in industry-specific loans to airlines, cargo carriers, and other critical businesses; allocates $454 billion in economic injury disaster loans to other businesses; and provides $150 billion in emergency assistance for state and local governments.[15] Delayed tax deadlines (extended by the IRS), suspended student loan payments, and penalty-free retirement withdrawals round out the economic relief to individuals and families.[16]

The SBA quickly ran through the first $349 billion allocated to the PPP, shutting out many small businesses. In April, H.R. 266, the Paycheck Protection Program Health Care Enhancement Act, was passed to provide an additional $321 billion to the PPP program. In addition, it provides $75 billion for health care providers, $25 billion for testing, and $62 billion to cover the incremental expenses of the SBA. This act will cost $483 billion in total.[17]

Economic Outlook

In all, the government has already committed roughly $3 trillion of monetary stimulus from the Fed and $2.7 trillion in fiscal stimulus by legislative action to combat the coronavirus and repair the US economy. There are additional plans in the works for more stimulus, and depending on how long the economic impact of COVID-19 lasts, the federal government has the power and will to spend whatever it takes to right the ship. Aggregated with the health care industry and global scientific and pharmaceutical resources employed against the virus, we are seeing an unprecedented financial and economic catalyst. Whatever one might forecast about the near-term prospects of a sustained economic recovery and a continued stock market rebound, or the length of time until we return to some sense of normal life, this financial tailwind should give companies time to chart a new course through these murky waters. With any luck, we will soon see positive pharmaceutical solutions to the pandemic on the horizon as well.

The future we behold may be quite different after the crisis recedes. As we accelerate toward a change in the way we live and work, Woodstock is seeking companies that will benefit in, or facilitate, that evolution, and endeavors to cede those that are vulnerable. On a macro-economic scale, the federal debt is growing by these trillions of dollars, crisis relief bills that borrow whatever is necessary on the full faith and credit of the US government. We expect this added fiscal burden to result in inflationary pressures, rising taxes and interest rates, and pressure on the US dollar against foreign currencies. These dynamics will impact stock sector leadership and shape investment strategy in the years to come.

For now, there will be continued market volatility to contend with and daily news to digest. There is also a plausible case for the stock market to revisit the March lows, but the intermediate-term economic outlook for the US is positive with this incredible level of stimulus. Though announced stimulus measures will take time to trickle through the economy, the potential lift is likely already reflected in asset prices. We can expect the ensuing economic recovery to be echoed in stock market returns over time, aligned with our assertion that stocks outperform other asset classes over the long term.

We construct our clients’ portfolios with a protracted time horizon for the stocks we hold, and recent market action has not changed that process. While you may see others panic in these kinds of markets, we see opportunity, and you can trust that we are making sound decisions for our clients. Sometimes that means making adjustments to portfolios to reflect the new economic realities for some holdings, harvesting tax losses, rebalancing asset allocations, etc., but you will likely not see major changes to the core holdings of our portfolios; they are built for the long haul.

Our philosophy endures market gyrations, that clients are best served by risk-appropriate allocations to high-quality equities while maintaining adequate cash reserves to meet their near-term needs. With many stimulus measures in place, and likely more to come, our view of the future is not without risk of more volatility, but is essentially constructive. Warren Buffett may have summed it up nicely with his recent quip: “Never bet against America.” [18]

Robert B. Sanders, Senior Vice President / Portfolio Manager