Woodstock Quarterly Newsletter / Q1 2020

The S&P 500 Index returned 31.5% in 2019, its best year since 2013, whereas the FTSE All-World Index returned 27.2%, its best year since 2009. The market began 2019 beset by concerns the Fed was tightening monetary policy too aggressively, anticipating additional rate hikes. As the Fed leaned towards incrementally easier policy throughout the year, ultimately cutting interest rates three times, the market went on to make new highs. All eleven sectors of the S&P 500 generated double digit returns, and almost every asset class did well.

After the US economy grew 2.9% in 2018 helped by the Trump tax cuts, economic growth returned to a more modest pace, growing an estimated 2.3% in 2019, and it is expected to grow 1.8% in 2020.[i] We remain in the longest economic expansion in our history. Global economic growth also slowed in 2019, from 3.6% in 2018 to 3.0% in 2019, and is forecast to grow 3.1% this year.[ii] The US Dollar remained largely stable during 2019, holding onto its approximately 5% gain in the previous year.

Strong market appreciation stood in stark contrast to earnings. Earnings for the S&P 500 companies were expected to be up just 0.6% year-over-year in 2019, meaning almost all of the market’s appreciation came from price-to-earnings multiple expansion. The stock market began 2019 trading at 15.5x the prior year’s earnings and ended the year trading at 19.9x the comparable metric. Higher earnings multiples are in part justified by lower interest rates – The 10-Year US Treasury yield fell from 2.69% at the beginning of the year to 1.92% by year end. Declining interest rates tend to favor growth stocks over value stocks. Yield-driven multiple expansion is not a great indicator that market appreciation is sustainable, but it doesn’t necessarily mean the market will surrender its gains either. Some stock appreciation potential was pulled forward into 2019. The market is trading at 18.2x forward earnings.

Interestingly, the consensus of Wall Street analysts is that S&P 500 earnings will reaccelerate, growing 9.5% in 2020 and 10.5% in 2021.[iii] These earnings expectations seem aggressive. Analysts must believe that earnings growth was suppressed last year. Investors may be counting on the Phase One Trade Agreement with China to stimulate growth, but the agreement seems unlikely to boost growth as tariffs remain in place on $370 billion worth of goods,[iv] and thornier trade issues remain unresolved. Investors may have confidence that monetary actions in 2019 will stimulate economic growth, even if this isn’t borne out in GDP forecasts. Further, investors may be anticipating a recovery in economies overseas, particularly Europe and China, which have been quite weak. Finally, the continuingly strong US Dollar made year-on-year growth comparisons more difficult in 2018 and 2019 for US companies with exports and operations overseas. If the Dollar trades in a range comparable to 2019 or lower, this headwind to year-over-year comparisons goes away.

Offsetting the potential for earnings growth however, 2020 is of course an election year. Elections tend to generate a fair amount of policy uncertainty and fear mongering, potentially affecting investor sentiment. The more extreme policy proposals face a very long road to enactment. Elections usually enable us to resolve some of this uncertainty. Hopefully we will be able to move forward in a positive direction afterwards.

The Fed finds another reason to ease

Federal Reserve activity had a clear impact on stock prices. In addition to the reversal on interest rates, a melt-down in one corner of the financial markets in September gave the Fed justification to ease monetary policy even more aggressively. The repo market, short for repurchase agreement market, is where financial institutions swap high quality bonds, usually US Treasury notes, for cash on an overnight or short-term basis. It is an essential way in which banks, brokers, money market funds, and hedge funds are able to satisfy their liquidity needs or earn interest on excess cash. Because the collateral bonds are high quality, interest rates are usually low, in the range of the federal funds rate. The repo market is supposed to be a very safe, reliable part of our financial infrastructure, but on September 17th it was not. On that date, repo rates spiked as high as 10%, indicating there were not enough providers of cash to meet borrowers’ liquidity needs. The proximate cause of the spike was that corporate tax bills were due to the US Treasury, plus a Treasury debt auction settled.

The Fed quickly stepped in, plying the repo market with cash in exchange for Treasuries, but the fact that rates rose at all exposed a larger problem. The Fed had believed that banks had ample excess reserves which could be lent into the repo market. Recall that the Fed had been draining the banking systems’ excess reserves beginning in late 2017 and continuing through the middle of 2019 by allowing bonds to mature and roll off its own balance sheet. When the Fed buys bonds, it credits its counter part banks with cash reserves. When Treasury bonds on the Fed’s balance sheet mature, the Treasury transfers cash to the Fed, thereby removing it from circulation. What the Fed had not realized is that the banks did not consider these reserves to be “excess,” but rather felt that they needed to hold cash in order to comply with the rubric of banking regulations implemented since the financial crisis. Fed officials should have had a better understanding of banks’ true reserve requirements, and with hindsight it is evident that the Fed’s efforts to reduce excess reserves was too aggressive.

From September through the end of the year, the Fed had injected some $256 billion into the repo market.[v] In addition, the Fed committed to buying $60 billion worth of US Treasury bills per month, at least into the second quarter of 2020. They purchased $157 billion through year end under this bond purchase program.[vi] In so doing, they are rebuilding banks’ “excess” reserves. In total, that makes $413 billion that the Fed has put into the markets over three and a half months. By comparison, the Fed was buying $85 billion of bonds per month at one point during its third quantitative easing program (QE3).

Fed officials insisted that these actions do not constitute monetary easing in the way that its previous quantitative easing programs have, but rather served merely as a liquidity fine-tuning mechanism. Fed Chairman Jerome Powell asserted: “Growth of our balance sheet for reserve management purposes should in no way be confused with the large-scale asset purchase programs that we deployed after the financial crisis.”[vii]However, both of the Fed’s current programs add to its balance sheet and at least temporarily add to the money supply. They are operationally very similar to the three quantitative easing programs the Fed put into effect from 2008-2014. The reserve management program walks like a duck and quacks like a duck.

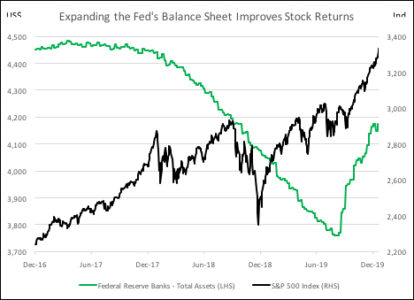

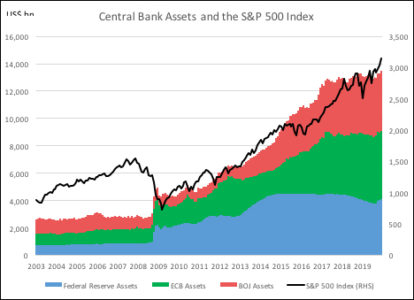

The mechanics by which these programs affect the stock market are debated, but the stock market marched steadily higher under each of the quantitative programs, as it is steadily marching higher now as we start the new year. Market volatility has declined. Lower volatility has, in turn, compelled investors to assume more risk, leaving price-sensitive investors at a disadvantage. The monetary stimulus has helped investors look beyond the fact that the Institute for Supply Managers’ Manufacturing Survey showed contraction in each of the last five months of 2019, although there have been a number of favorable economic statistics generated at the same time (for instance, housing and retail). We believe the monetary stimulus will help lift the Manufacturing Survey back into expansion mode in 2020 as well as continuing to provide a lift to stock prices.

Source: St. Louis Federal Reserve

There are two accompanying charts showing the role of central banks’ balance sheets and the rise of the S&P 500 Index over time. The 3-year chart shows the S&P 500 rallying in 2017 on news of Trump’s tax cuts. The market began to sell off in late 2018 on concerns that the Fed was tightening too aggressively, and partly on news that the US-China trade war was heating up. The market bottomed at year end 2018, and rose through 2019 as the Fed relaxed its stance both on interest rates and on quantitative tightening. Market participants had advanced warning that the Fed would stop shrinking its balance sheet.

Source: St. Louis Federal Reserve, FactSet

Risks to financial stability

It was necessary for the Fed to intervene in the repo market. The Fed took decisive action to prevent a calamity from broadening into a larger financial problem. Having resolved the problem, we believe Fed officials intend to exit the repo market. The Fed’s second initiative, buying Treasury bills outright, offers a way for the Fed to support banks and the markets while extricating itself from direct lending in the repo market. Then, the Fed will need to stop buying Treasury bills. With Treasury issuance only set to expand however, the repo market may continue to face higher than expected demands for cash.

Not wanting to be accused of influencing the election, the Fed most likely wants to limit its involvement in the markets this year. They may have eased aggressively in 2019 so that they could avoid adjusting monetary policy this year. They are unlikely to move the fed funds rate until after the election, but their retreat from the repo market and plans to curb Treasury purchases may still clash with their aspirations for limited involvement.

The Fed must balance the danger of having too heavy a hand in the markets with that of extricating itself too quickly. Aggressive monetary policy has more readily manifest itself in asset prices than in inflation statistics, and it is clear Fed officials are very mindful of the level of markets. If the Fed withdraws stimulus too quickly, asset prices will fall. If the Fed provides too much stimulus, it risks creating an asset bubble. If the Fed moderates its programs deftly, the stock market won’t be disrupted.

Although stock valuations are on the high side now, they are still largely grounded in fundamentals. The underlying economy continues to experience steady, if moderate growth. In a bubble, prices diverge from any semblance of economic value. We aren’t there, a few individual stocks notwithstanding. Complicating the calculus, if interest rates remain low for the investable future, then higher valuations are justified.

Problems in the repo market are not a reason to be bullish on stocks, and yet the Fed’s remedy is intentionally overpowering. The Fed seems inclined to err on the side of too much intervention in the markets rather than too little. If that’s the case, our clients will continue to benefit from staying fully invested in the market. It remains difficult to determine how long the Fed’s boost can last and if the Fed will be able to step down their intervention without disrupting markets. Ideally, we could anticipate what the Fed will do and assess the efficacy of their plan, while anticipating inflections in various economic sectors as well as how investor sentiment will impact valuation levels. But these are investment tactics, not strategy. We cannot forecast tactical trades consistently, nor do we believe anyone else can. Our long-term strategy, to the extent that clients can tolerate the risk, is to keep funds which won’t be needed in the next few years invested in stocks. We add further value by finding great companies and buying their shares at reasonable prices. Even from somewhat elevated valuation levels, we believe stocks offer a better blend of return potential and liquidity than any other asset class.

Adrian Davies, President

[i] Bloomberg Economic Forecast function, 1/15/2020.

[ii] Op. Cit.

[iii] FactSet Earnings Insight, 12/20/2019 and 1/10/2020.

[iv] Davis, Bob, Lingling Wei, and William Mauldin, “U.S., China Sign Deal Easing Trade Tensions,” Wall Street Journal, 1/15/2020.

[v] Harris, Alexandra, “Fed Wins Year-End Repo Battle, But War to Control Rates Drags On,” Bloomberg News, 12/31/2019.

[vi] Op. Cit.

[vii] Popina, Elena, “The Debate Over Whether to Call It QE Is Over, and the Fed Lost,” Bloomberg News, 1/17/2020.