Peering Down From Way Above Trend

Assessing the trends in certain data sets helps portfolio managers grapple with the TINA problem and how to best rebalance portfolios for the long term. Because of the devastating effects of the COVID-19 virus on economic and financial statistics, investors absorbed large negative rates of change early on until those depressed numbers became denominators for more recent data. But investors have been treated to many astonishing rates of change over the last year because of easy base-period comparisons. In most cases, the percentage changes or growth rates have conformed to a classic sine curve pattern. But those puffed-up numbers have now passed, and we are on to discerning what longer term trend growth will be for many of our favorite data series.Being above trend over some time period implies negative second derivative performance ahead, a negative change in the rate of change. Growth slowing from 17% to 10% or 5% would be a negative second derivative even if still positive absolute growth. For a portfolio manager, this has implications for portfolio construction in terms of asset mix (allocation) and potentially sector diversification because above-trend performance can drive above desired equilibrium exposure to an asset class or to an economic sector of the market.

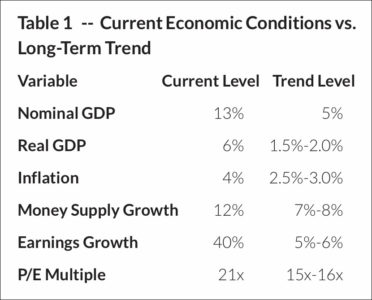

What does getting back to trend look like? In terms of inflation, the capital markets have concluded that 2.5% is the central tendency, RGDP growth is 1.5%-2.0% based on reasonable population and productivity growth assumptions, corporate earnings growth of 5% or nominal GDP growth because higher corporate tax rates and margin pressure will offset share buyback influence. P/E multiples (now two standard deviations above average 15x) will drift lower as negative real interest rates lessen and/or go positive from their current -1% to -2% levels. Asset class returns (cash, bonds, stocks) and their implication for asset mix and sector allocation decisions will result from these interactions.

The TINA Problem

The term TINA (“There Is No Alternative”) is alive and well, but so too is the capital preservation instinct. Since year-end 2015 (i.e., 2016 to 2021 YTD), stocks have so outperformed bonds that a 60% exposure at year-end 2015 would be 11% points (~20%) higher, resulting in a 71% equity/29% cash and bond mix. While time horizon, estate tax planning and other considerations enter the discussion for taxable portfolios, the above-trend performance reality presages regressing to or below trend in future periods.

Recent equity returns and corporate earnings growth have been so far above trend that many may have forgotten what trend was. Some representative examples are shown in Table 1 below.

Equity Returns Face Headwinds

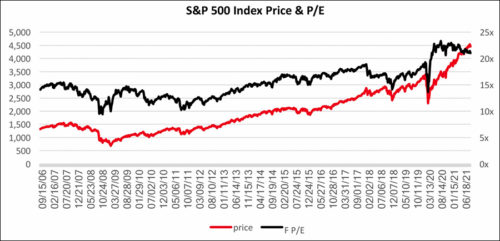

The current forward P/E (F P/E) of the S&P 500 of 21x is two standard deviations above the fifteen-year average of 15x. This looms as a powerful headwind to equity returns in the event that competing bond yields ever reflect a positive “real” rate of return component in contrast to today’s negative 1-2 percent. The F P/E has been going sideways since March 2020 (see Figure 1 above), which reflects the adjustment underway to reflect growth deceleration and capital market normalization.

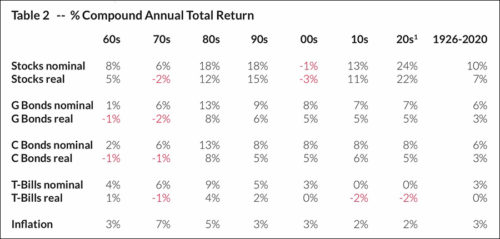

Rebalancing portfolios can be exacerbated by the investment mantra “TINA,” which refers to there being no alternative to equities with a cash return-less asset class as well as negative real returning bond asset class. As Table 2 below shows, this expression really gained currency in the last two decades as nominal yields fell to zero, creating negative real returns of 2 percent. This stands in stark contrast to history. which shows that cash (T-Bills) has returned the rate of inflation or no “real” rate of return compared to stocks and bonds which have both provided positive “real” investment returns. But recent history (the last two decades) shows that both stocks and bonds are well above trend in nominal and “real” returns. Bonds of both stripes and T-Bills, however, remain mired in low nominal, negative “real” return territory.

1 Decade to date 11/5/21

• G Bond = government bonds

• C Bond = corporate bonds

• Two-digit historical return precision is highly overrated in forward return forecasting and our focus on the last sixty years (not Ibbotson back to 1926) is intended to highlight where returns are above/below trend and what reversion to trend may look like.

Pruning the garden, or portfolio rebalancing in an investment context, is an important strategic activity particularly during and/or after well-above-trend asset return periods. The tug-of-war between overexposure to equities resulting from the last several years’ performance may have resulted in above-equilibrium exposures in both an asset mix and economic sector sense. But addressing them runs into the TINA problem as the reinvestment return seems so inferior. High, above-trend valuations can be associated with low prospective returns which often follow. Just mean regression at work.

Thomas C. Stakem

What’s a Client to Do?

Tom’s Stakem’s article, “Peering Down,” is a graduate course in finance and investment in three pages with charts focused on what’s happening now and likely to happen over the next two to three years. Good companies either held or bought now have a good chance to perform well compared to an index or an alternative asset class. Quality companies bought now have a good chance to hold their value or recapture it when negative financial events or extraordinary international events happen.

Portfolio managers at Woodstock research the companies on our Monitor List not only to know when to purchase them in client accounts, but also to know the appropriate time to sell them. Individual stock selection can be an advantage for individually managed portfolios. In the recent past, it has been a great advantage at Woodstock. Putting good companies into client portfolios is how Woodstock’s investment managers are evaluated, not necessarily on short-term client account performance. As clients ourselves, we intend to keep trusting that system over the long term.

William H. Darling, client

Henry P. Phippen, client